RCF Innovation

Mining innovation aiming to make mining safer, better, and more efficient

Mining innovation aiming to make mining safer, better, and more efficient

Overview

RCF Innovation is a growth private equity investment strategy in the mining innovation sector and is at the forefront of emerging technologies and ideas in the mining sector. The RCF Innovation team is continually scanning and evaluating mining technology products and services from around the world and has extensive relationships with leading research institutions and universities globally. The RCF Innovation Strategy invests in high growth mining equipment, technology and services (METS) companies. The METS sector presents investment opportunities, magnified during periods of volatile commodity prices and/or high operating costs. Mining companies rely increasingly on METS companies to provide incremental as well as step-change solutions to improve productivity and lower costs.

Relied on globally for mine finance

Investment Highlights

A focus on innovation

- Innovation and emerging technologies will redefine the mining industry to help sustainably and efficiently meet the demand for critical minerals and resources

- We focus on high value-add solutions within the mining value chain, aligned with key industry themes that aim to make mining safer, better, and more efficient

- We believe strong returns can be created by investing in best-in-breed mining innovation companies with high growth potential

Leverage global innovation networks for proprietary deal flow

- We offer growth equity via specialist exposure to the mining innovation sector with a focus on key mining innovation regions of Australia, North America, and Europe with equity investment size typically ranging from $1M – $20M

- We are continually evaluating mining technology products and services globally, and have extensive relationships with leading research institutions and universities to help us find and attract proprietary deals, without competition

- We deploy capital for influential ownership positions and once invested, we deploy expertise and seek to create world leading companies; accelerating growth, and preparing companies for future acquirers

Uniquely positioned, unique experience

- RCF Innovation is a recognized brand within the mining innovation and METS sector as the only growth private equity investment strategy in the mining innovation sector

- We provide hands-on exit planning and execution to drive exit strategies and sell businesses to strategic players

- We have an experienced team with extensive commercial experience in mining, technology, and private equity. The team has a track record of success in commercializing new technologies having made 40+ investments in technology companies since 2003

RCF Innovation Panel Discussion Highlights

RCF Innovation II Preqin Award Recognition

RCF Innovation II Ranks in the Top 10 Performing Natural Resource Funds under $250mn by Net IRR for 2025

This Preqin Badge was awarded to the RCF Jolimont Mining Innovation Fund II (the “Fund”) on April 2, 2025, by Preqin, a provider of comprehensive alternative assets data. It reflects a ranking of 169 natural resources funds of similar size (under $250 mm) and similar vintage (2017-2022) in Preqin’s database. The performance period used by Preqin for the Fund is from its inception on December 21, 2020, through September 30, 2024 (note: RCF provided Preqin with Fund performance data through September 30, 2024). No compensation has been provided by Resource Capital Funds or its affiliates in connection with obtaining or using this Preqin rating. Third-party ratings and recognition do not guarantee future investment success and do not ensure a higher level of performance or results.

ESG and RCF Innovation II

Learn more about RCF Innovation II’s approach to decarbonization for the portfolio companies it’s currently investing in.

ESG & RCF Innovation II

Foremost providers of mine finance

Portfolio

Related Insights

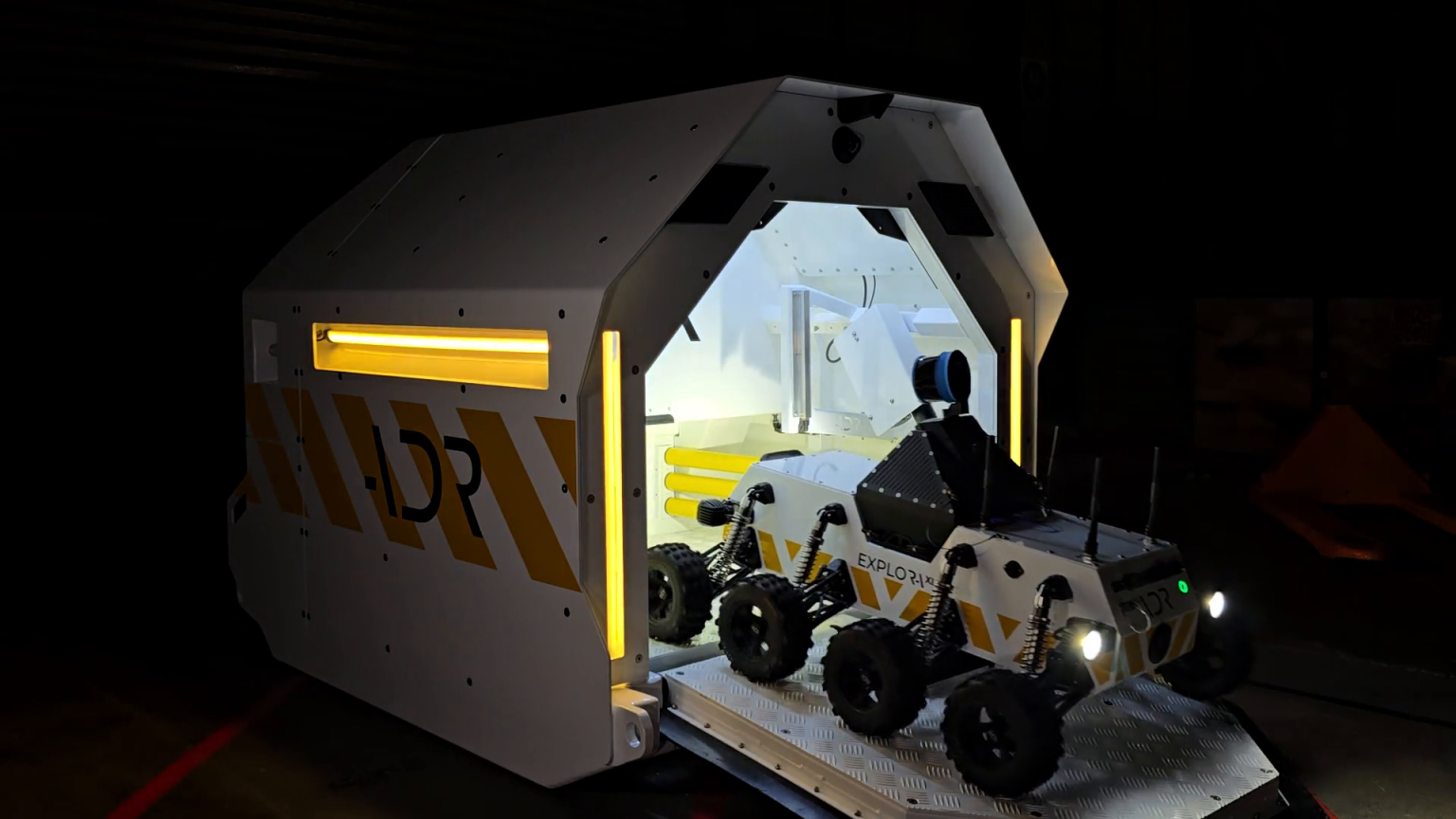

A first look at the ADR Docking Station…

The ADR Docking Station—the key to unlocking truly persistent, remote operations for the Explora robot

RCF Innovation II Portfolio Company Wins Gold Award

Phibion, a portfolio company in RCF Innovation II, has been named a Gold Award Winner…

Charles Gillies Discusses METS Sector

Charles Gillies, MD, RCF Innovation discusses mining industry pressures and innovation with MiningMonthly.com

Disclaimer

This is not an offer or solicitation with respect to the purchase or sale of any security.

RCF Innovation I is a partnership in which Resource Capital Fund VI L.P. (“RCF VI”) is an investor. It is managed by the RCF Innovation team, who were the principals of Jolimont Global Mining Systems Pty Ltd before and after it was acquired by RCFM in September 2019. Two of the same three principals currently manage RCF Jolimont Mining Innovation Fund II in a substantially similar manner to RCF Innovation I. Total performance results for RCF VI are available upon request.

The information in this webcast is provided for educational purposes only and should not be construed as research. The opinions expressed may change as subsequent conditions vary. The information and opinions contained herein are derived from proprietary and non-proprietary sources deemed by Resource Capital Funds and/or its affiliates (together, “RCF”) to be reliable. No representation is made that this information is accurate or complete. There is no guarantee that any forecasts made will come to pass.

This webcast is not intended to provide investment advice. It is for informational purposes only and may not be relied on in any manner as investment advice or as an offer to sell or a solicitation of an offer to buy or sell any securities, product, or service, including interests in any fund managed by RCF or its affiliates. Any such offer or solicitation shall only be made pursuant to a final confidential private placement memorandum, which will be furnished to qualified investors on a confidential basis at their request. RCF does not guarantee the suitability or potential value of any particular investment. Investing involves risk, including possible loss of principal. The merits and suitability of any investment should be made by the investing individual. Reliance upon information in this webcast is at the sole discretion of the viewer.

The portfolio companies featured in this webcast are a reflection of the RCF Innovation strategy, and references to these particular portfolio companies should not be considered a recommendation of any particular security, investment, or portfolio company. The information provided about these portfolio companies is intended to be illustrative and should not be used as an indication of the current or future performance of RCF’s portfolio companies. A full list of portfolio company holdings is available upon request.

Certain information contained herein relating to any goals, targets, intentions, or expectations, including with respect to Environmental, Social and Governance (“ESG”) targets and related timelines, is subject to change, and no assurance can be given that such goals, targets, intentions, or expectations will be met. There can be no assurance that RCF’s ESG policies and procedures as described in this report, including policies and procedures related to responsible investment or the application of ESG-related criteria or reviews to the investment process will continue; such policies and procedures could change, even materially, or may not be applied to a particular investment. RCF is permitted to determine in its discretion that it is not feasible or practical to implement or complete certain of its ESG initiatives, policies, and procedures based on cost, timing, or other considerations. Statements about ESG initiatives or practices related to portfolio companies do not apply in every instance and depend on factors including, but not limited to, the relevance or implementation status of an ESG initiative to or within the portfolio company; the nature and/or extent of investment in, ownership of or, control or influence exercised by RCF with respect to the portfolio company; and other factors as determined by investment teams, corporate groups, asset management teams, portfolio operations teams, companies, investments, and/or businesses on a case-by-case basis. ESG factors are only some of the many factors RCF considers in making an investment, and there is no guarantee that RCF will make investments in companies that create positive ESG impact or that consideration of ESG factors will enhance long term value and financial returns for limited partners. To the extent RCF engages with portfolio companies on ESG-related practices and potential enhancements thereto, there is no guarantee that such engagements will improve the financial or ESG performance of the investment. In addition, the act of selecting and evaluating material ESG factors is subjective by nature, and there is no guarantee that the criteria utilized, or judgment exercised by RCF will reflect the beliefs or values, internal policies or preferred practices of investors, other asset managers or market trends.