Strategies

Distinct Strategies, Diversified Platform

Active Private Equity Investors

Diversified Platform of Mining-Specific Strategies

Our investment management teams are organized around distinct investment strategies aimed at providing capital throughout the development, capital structure, and risk/reward spectrum.

Private equity for the energy transition

RCF Private Equity

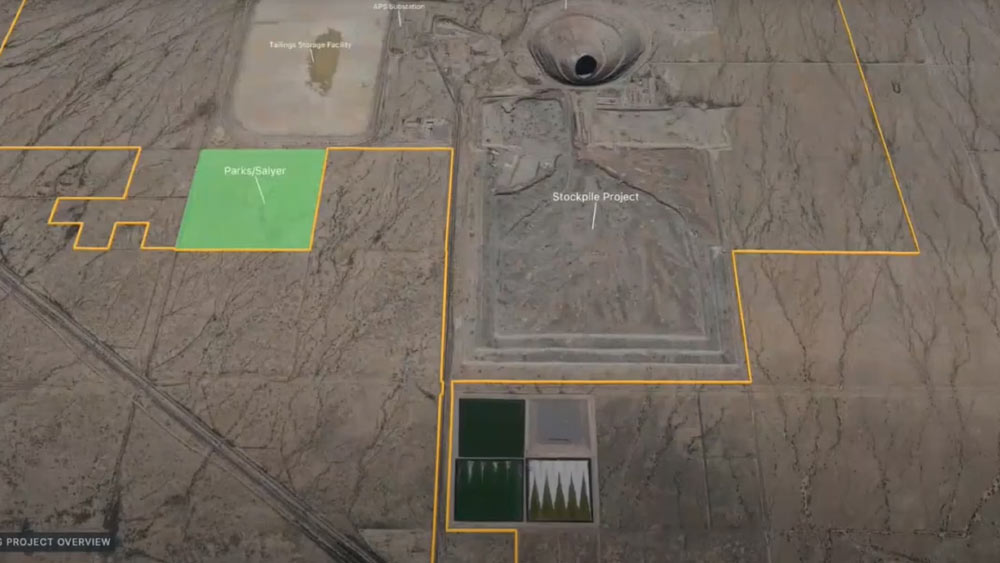

The RCF Private Equity strategy seeks to achieve significant returns from investments in the mining industry. It is founded on the belief that the world is undergoing a paradigm shift in the demand for metals and minerals. The RCF Private Equity strategy seeks a leading role in advancing projects to cash flow through a focus on late-stage assets in strong mining jurisdictions.

Martin Valdes

Partner, Head of Private Equity

Capturing opportunities across the mining sector

RCF Opportunities

The RCF Opportunities strategy rests on the belief that meeting the planet’s surging demand for metals, driven by technological innovation, changing demographics, and global electrification and decarbonization objectives, relies on new discoveries and project advancement. To offset the natural risks of early-stage exploration, the RCF Opportunities Strategy pursues a diversified and relatively unconstrained approach that seeks to lower volatility, flatten the j-curve, and generate realizations during and after the investment period.

Russ Cranswick

Partner, Head of Opportunities

Aiming to make mining safer, better, and more efficient

RCF Innovation

The RCF Innovation Strategy is a growth private equity investor focused exclusively on the mining innovation sector. The energy transition, ESG requirements, and the declining quality and remoteness of mineral reserves are forcing the mining industry to transform itself. The RCF Innovation Strategy seeks to establish equity positions with significant control and influence to enable successful scale up and position innovative firms for high-value exits. Innovation is vital to mining and we believe this niche sector has a large and fast-growing revenue potential. The Strategy generally invests in a balanced portfolio of 10-15 growth equity deals across APAC, North America, and Europe.

Andrew Jessett

Head of Innovation