Stewardship

Responsible Mining for a Sustainable Future

A holistic approach

Mining is not a choice. How we mine is.

Assessing impact, generating value

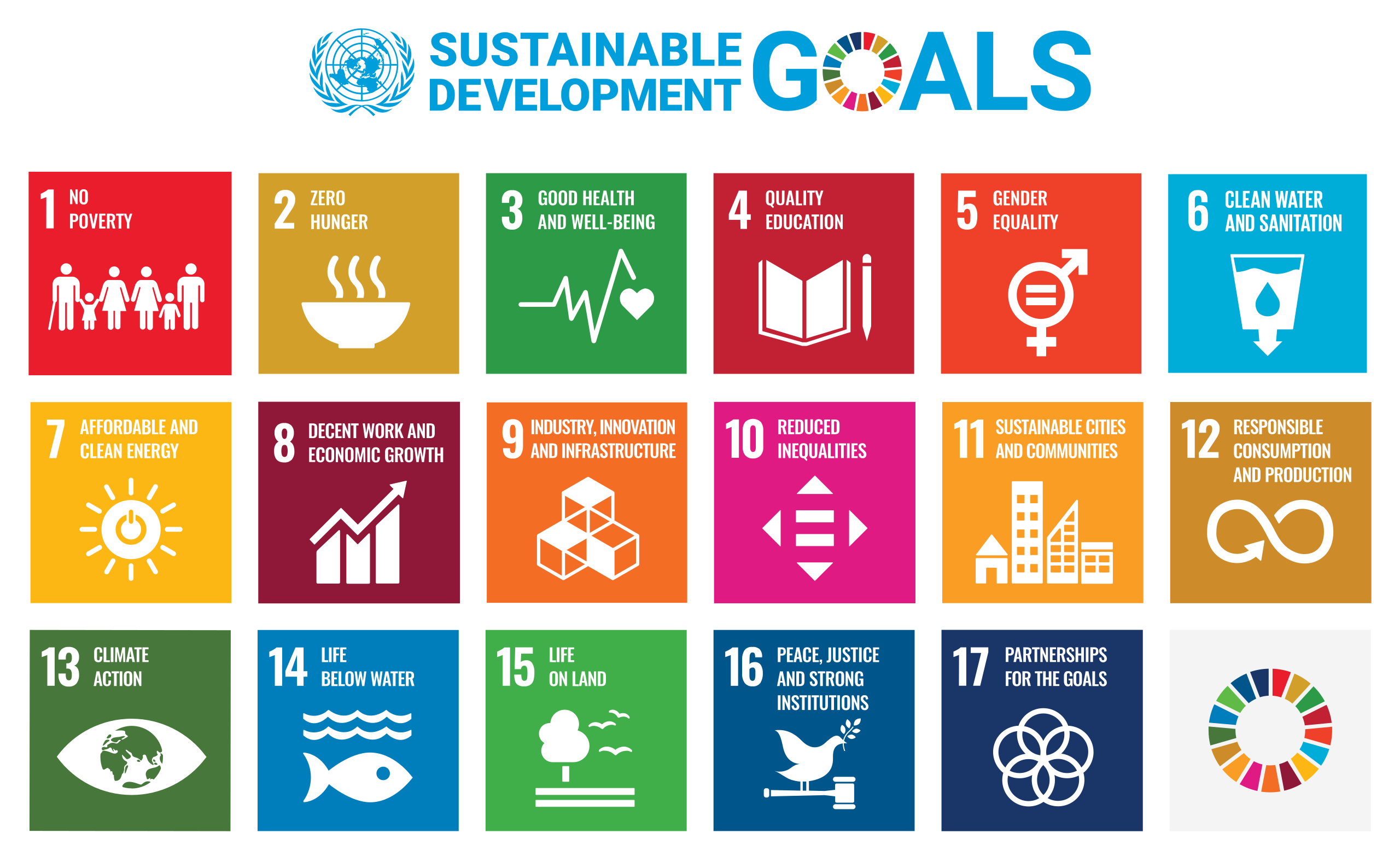

ESG Focus Areas

At Resource Capital Funds, we recognize the breadth of ESG themes in mining. We adopt a holistic approach to carefully look at all aspects of Environment, Social, and Governance impacts, while also looking to generate value and benefit local communities. We strive to identify and assess impacts and risks, while also looking to generate and protect value from the many benefits mining can bring to local communities.

Six principles

Responsible Investment Stewardship

RCF has been a signatory of the UN-supported Principles of Responsible Investment since 2013. The PRI urges investors to integrate ESG factors into investment decision-making and active ownership practices. When practicable, RCF commits to the following six Principles:

- Principle 1

- RCF will incorporate ESG issues into investment analysis and decision-making processes.

- Principle 2

- RCF will be active owners and incorporate ESG issues into ownership policies and practices.

- Principle 3

- RCF will seek appropriate disclosure on ESG issues from portfolio companies.

- Principle 4

- RCF will promote acceptance and implementation of the Principles within the investment industry.

- Principle 5

- RCF will work together with industry and the investment community to enhance the effectiveness in implementing the Principles.

- Principle 6

- RCF will report on activities and progress towards implementing the Principles.

1

Investment Analysis & Decision Making

ESG impacts, risks and opportunities are considered at all stages in RCF’s Investment Decision Making Process.

- Screening

- Pre-Investment Due Diligence

- Exit Phase

2

Stewardship & Engagement

At RCF we are active owners and promote the Principles of Responsible Investment by:

- Direct Portfolio Company Engagement

- ESG Performance Data

- Board and ESG Committee Participation

- Proxy Voting

- Industry Engagement

3

Disclosure & Standards

RCF seeks to report on its Responsible Investment practices and performance through:

- Publishing an Annual ESG Report

- Alignment with the Task Force on Climate-Related Financial Disclosures and Sustainability

- Accounting Standards Board frameworks

- Signatory to the PRI and reporting annually

- Participating in the Institutional Limited Partners Association – ESG Data Convergence Initiative

- RCF’s Annual General Meeting

4

Governance & Responsibilities

Responsibilities for RCF’s approach to responsible investment governance includes:

- RCF Senior Leadership

- ESG Committee

- Investment teams

- ESG Practitioners

Committed to ESG

Strong Internal ESG Governance

The RCF ESG Committee is focused on meaningful impact through continuous improvement, prioritization, and focus on ESG. It’s primary responsibilities include:

- Governing the development and implementation of responsible investment practices

- Monitoring ESG performance

- Providing internal ESG awareness and training.

ESG Committee

Important Information

The data and information on this website (“Website”) is presented for informational purposes only by Resource Capital Funds and/or its affiliates (together, “RCF”). This Website shall not constitute an offer to sell or the solicitation of any offer to buy any interest, security, or investment product. The information in this Website is only as current as the date indicated and may be superseded by subsequent market events or for other reasons, and RCF assumes no obligation to update the information herein. Nothing contained herein constitutes investment, legal, tax, or other advice nor is it to be relied on in making an investment or other decision.

Certain information contained herein relating to any goals, targets, intentions, or expectations, including with respect to Environmental, Social and Governance (“ESG”) targets and related timelines, is subject to change, and no assurance can be given that such goals, targets, intentions, or expectations will be met. There can be no assurance that RCF’s ESG policies and procedures as described in this report, including policies and procedures related to responsible investment or the application of ESG-related criteria or reviews to the investment process will continue; such policies and procedures could change, even materially, or may not be applied to a particular investment. RCF is permitted to determine in its discretion that it is not feasible or practical to implement or complete certain of its ESG initiatives, policies, and procedures based on cost, timing, or other considerations. Statements about ESG initiatives or practices related to portfolio companies do not apply in every instance and depend on factors including, but not limited to, the relevance or implementation status of an ESG initiative to or within the portfolio company; the nature and/or extent of investment in, ownership of or, control or influence exercised by RCF with respect to the portfolio company; and other factors as determined by investment teams, corporate groups, asset management teams, portfolio operations teams, companies, investments, and/or businesses on a case-by-case basis. ESG factors are only some of the many factors RCF considers in making an investment, and there is no guarantee that RCF will make investments in companies that create positive ESG impact or that consideration of ESG factors will enhance long term value and financial returns for limited partners. To the extent RCF engages with portfolio companies on ESG-related practices and potential enhancements thereto, there is no guarantee that such engagements will improve the financial or ESG performance of the investment. In addition, the act of selecting and evaluating material ESG factors is subjective by nature, and there is no guarantee that the criteria utilized, or judgment exercised by RCF will reflect the beliefs or values, internal policies or preferred practices of investors, other asset managers or with market trends.

RCF Innovation I is a partnership in which Resource Capital Fund VI L.P. (“RCF VI”) is an investor. It is managed by the RCF Innovation team, who were the principals of Jolimont Global Mining Systems Pty Ltd before and after it was acquired by RCFM in September 2019. Two of the same three principals currently manage RCF Jolimont Mining Innovation Fund II in a substantially similar manner to RCF Innovation I. Total performance results for RCF VI are available upon request.