History

Pioneers past, present, and future

Groundbreaking

25+ years of innovation in private equity mining investment

Pioneering

As banks and traditional investment firms look to shed mining assets from their balance sheets, James McClements and Henderson Tuten founded Resource Capital Funds—the pioneer in private equity mining—with initial backing from N.M. Rothschild & Sons.

RCF raises capital for its original vintage RCF I with a tight mandate to take advantage of new mining-specific opportunities

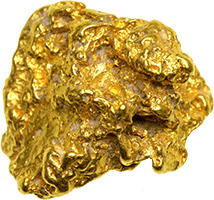

Gold

Gold

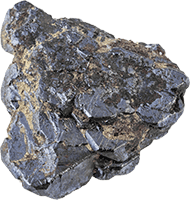

Zinc

Zinc

Canada

Canada

Romania

Romania

Burkina Faso

Burkina Faso

Ghana

Ghana

Philippines

Philippines

Perlite

Perlite

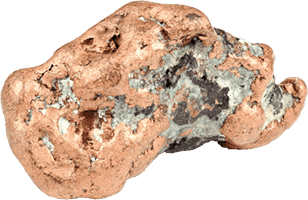

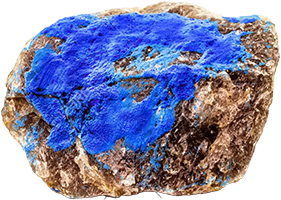

Copper

Copper

Uranium

Uranium

Titanium

Titanium

Portugal

Portugal

Mexico

Mexico

Tanzania

Tanzania

Australia

Australia

Kenya

Kenya

United States

United States

Russian Federation

Russian Federation

Independent

The first independent raise is completed for RCF II. A second office is opened in New York, and the first Annual General Meeting is held in Las Vegas, NV.

Seeking greater agility and operational freedom, RCF management buys out Rothschild's interest.

Honduras

Honduras

Thailand

Thailand

French Guiana

French Guiana

Thermal Coal

Thermal Coal

Nickel

Nickel

Aggregates

Aggregates

China

China

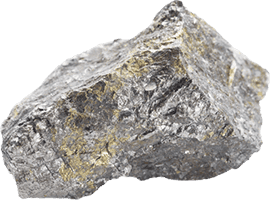

Metallurgical Coal

Metallurgical Coal

Technical

International expansion begins with the opening of the Perth, Australia office. RCF begins to build out its multi-disciplinary, in-house technical platform with an early focus on geology. The RCF Technical team would continue to be built out throughout the next decade with specialists in metallurgy, engineering, and construction onboarded.

Magnesium

Magnesium

Solomon Islands

Solomon Islands

Hungary

Hungary

Peru

Peru

Namibia

Namibia

Ferro-chrome

Ferro-chrome

Azerbaijan

Azerbaijan

South Africa

South Africa

Strategic

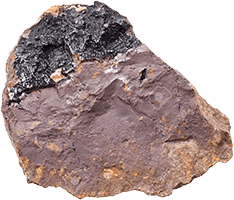

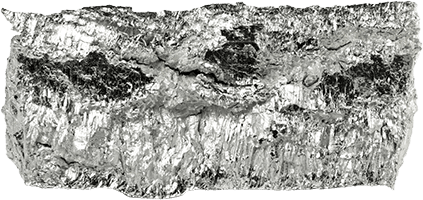

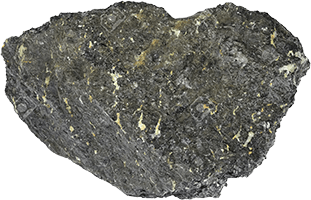

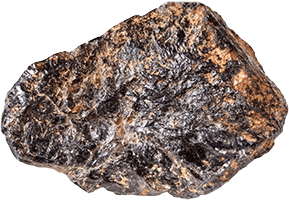

Taking advantage of market cycle conditions, RCF IV is strategically positioned in minor metals: Low production volume metals such as titanium, tantalum, and molybdenum that are difficult to extract and not typically traded on an exchange. Many are critical to technologies in pharmaceutical, battery, aviation, and other advanced sectors.

Tin

Tin

Iron Ore

Iron Ore

Morocco

Morocco

Chile

Chile

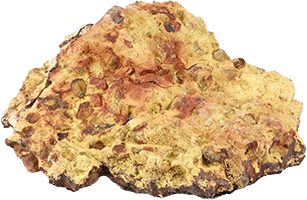

Bauxite

Bauxite

Cobalt

Cobalt

Wollastonite

Wollastonite

Lithium

Lithium

Spain

Spain

Papua New Guinea

Papua New Guinea

Foundation

With grants to over 100 organizations since its inception, the RCF Foundation was created to support social change and promotes sustainable development in local and mining communities.

Rare Earth Elements

Rare Earth Elements

Molybdenum

Molybdenum

Botswana

Botswana

Indonesia

Indonesia

Development

After a 10-year track record of success, RCF begins raising capital for RCF V, which seeks to take advantage of lucrative earlier-stage project development opportunities.

Tungsten

Tungsten

Saudi Arabia

Saudi Arabia

United Kingdom

United Kingdom

Potash

Potash

Tantalum

Tantalum

Mali

Mali

Guyana

Guyana

Greenland

Greenland

Greece

Greece

Ethiopia

Ethiopia

Mongolia

Mongolia

Jamaica

Jamaica

Mineral Sands

Mineral Sands

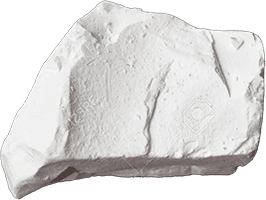

Calcium Carbonate

Calcium Carbonate

Colombia

Colombia

Brazil

Brazil

Senegal

Senegal

Expansion

RCF expands its investment approach to encompass the full spectrum of project development risk, better accommodating different investor profiles. A South American office is opened in Santiago, Chile. Seed funding allocated to mining innovation strategy to spur - and take advantage of - industry technology advances.

RCF becomes a signatory to the United Nations-supported Principles for Responsible Investment (PRI), furthering its commitment to responsible mining practices.

Diamonds

Diamonds

Lesotho

Lesotho

India

India

Armenia

Armenia

Democratic Republic of the Congo

Democratic Republic of the Congo

Turkey

Turkey

Guinea

Guinea

Partnership

RCF evolves to become a formal partnership structure to broaden ownership and governance of the firm, establish a more entrepreneurial culture, and ensure the future growth and sustainability of the firm.

Platinum

Platinum

Argentina

Argentina

Ecuador

Ecuador

Egypt

Egypt

Diversification

With multiple funds series focused on specific phases of the mining lifecycle, including RCF Opportunities Fund meant to focus on smaller, non-controlling positions from exploration through production, RCF is now able to provide investors a broader array of choices. RCF Private Equity Fund I begins to diversify its approach by focusing on both growth and value investment strategies.

Analytics

RCF provides seed funding and establishes 4CDA, a data analytics and consultancy providing data management, advanced analytics, digital innovation and data visualization support to external clients and RCF.

Silver

Silver

Salts

Salts

Kazakhstan

Kazakhstan

Japan

Japan

Acquisition

The Jolimont Innovation team joins RCF to further diversify investment opportunities for our limited partners and gain exposure to mining innovation.

Innovation

Despite battling global lockdowns from COVID-19, RCF continues its multi-fund strategy with the launch of RCF Jolimont Mining Innovation Fund II and II-A L.P. (RCF Innovation II), focused exclusively on the high-growth Mining Equipment, Technology, and Services (METS) sector. Mine operators increasingly rely on these companies for innovations that improve productivity, make mines safer, and lower costs.

Platinum Group Metals (PGM)

Platinum Group Metals (PGM)

Panama

Panama

Djibouti

Djibouti

Critical Minerals

Critical Minerals

Vanadium

Vanadium

Gabon

Gabon

Ivory Coast

Ivory Coast

Bosnia and Herzegovina

Bosnia and Herzegovina

Cayman Islands

Cayman Islands

Anniversary

After 25 years of business success, RCF celebrates its silver anniversary at the 2022 Annual General Meeting in Denver, CO.

Regulations such as the The Inflation Reduction Act are spurring critical mineral investment, and the accelerating green energy transition sets the stage for a new commodities supercycle.

Palladium

Palladium

#EnergyTransition

With major trends including decarbonization, mining underinvestment, ongoing population growth and consumption, and global government action and investment set to transform the commodities marketplace, RCF focuses on new Private Equity strategies and opportunities.

Exits

In 2024, Resource Capital Funds exited 29 positions and generated distributions of more than $325M to its limited partners. This milestone represents the largest amount since 2011, and the 3rd most active year in the firm’s history.

Disclaimer

RCF Innovation I is a partnership in which Resource Capital Fund VI L.P. ("RCF VI") is an investor. It is managed by the RCF Innovation team, who were the principals of Jolimont Global Mining Systems Pty Ltd before and after it was acquired by RCFM in September 2019. Two of the same three principals currently manage RCF Jolimont Mining Innovation Fund II in a substantially similar manner to RCF Innovation I. Total performance results for RCF VI are available upon request.