Executive Summary

- Western governments are increasingly intervening in critical mineral commodity marketplaces in an effort to achieve strategic energy transition and supply chain diversification objectives.

- Current initiatives are often focused on advancing mining projects through direct government investment including grants, loans, and loan guarantees to build new mines.

- While this approach is helpful, additional policies are needed to incentivize private sector investment which is essential in fully funding new mine development.

- While perceived future demand for critical minerals is clear, current commodity prices, which do not reflect the future projected imbalance, are disincentivizing private sector capital investment.

- Despite massive long-term demand trends for critical minerals and direct government-subsidized projects, many critical and strategic minerals have relatively small markets and are prone to greater price volatility and may require alternative government support mechanisms.

An Alternative Approach

Western governments, in collaboration with private capital, should strategically select mining projects to support and underwrite the commodity price risk (e.g., create a price floor). This approach, for those select mining investments, can help minimize price volatility.

This would incentivize the mining industry and private capital to invest with more predictability, fostering the long-term supply growth needed to attain national security and energy transition objectives. This approach could redeploy existing tax dollars allocated for critical mineral security, and potentially require less government investment overall.

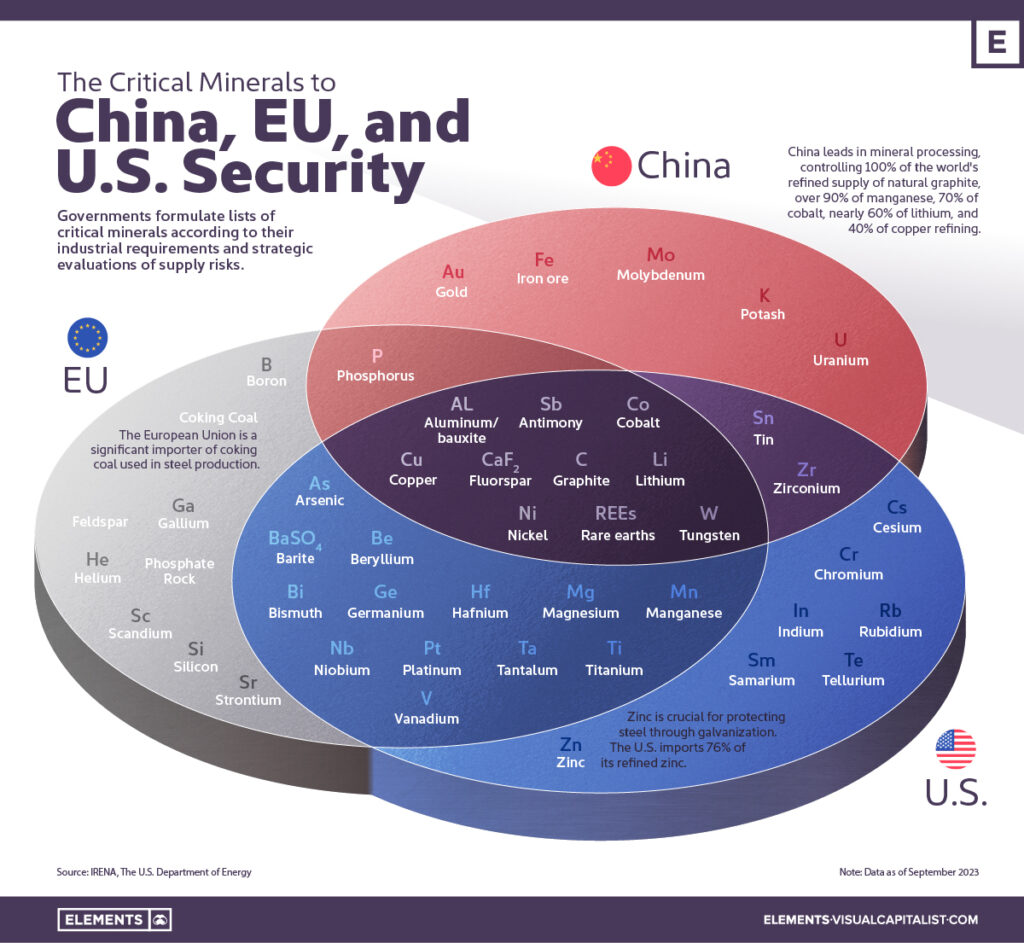

The Importance of Critical and Strategic Minerals in the New Global Economy

The Energy Transition

The world is undergoing an historic shift away from a carbon-fueled economy, towards a greener, more sustainable energy usage paradigm. However, the products and technologies that enable this transition are far more mineral and metal intensive than their conventional counterparts: an internal combustion engine (ICE) car contains about 35 kg of critical minerals, compared to around 210 kg of copper, lithium, cobalt, graphite, and rare earth elements (REEs) in an electric vehicle (EV)1. But EVs are not the only source of increased mineral demand: virtually every form of clean and renewable energy generation – from wind turbines to solar arrays and nuclear power plants – requires more critical mineral and metal inputs per kilowatt of production capacity compared to conventional coal, gas, and petroleum power plants.

Exponential Growth of AI Computing

While decarbonization drives the need for mineral-intensive electrical infrastructure, ChatGPT has become a harbinger for the growth and utility of artificial intelligence (AI) in home and the workplace. Logarithmic growth projections for artificial intelligence (AI) are driven by data centers that perform a vastly higher number of computations per second compared to conventional servers, requiring far more electricity. And since each computation generates a small amount of heat, more energy-intensive cooling is also required. Scientific American reports that the 1.5 million AI servers that NVIDIA alone is projected to ship in 2027 would consume at least 85.4 terawatt-hours of electricity per year – more than many small countries. That’s why Goldman Sachs forecasts that AI data centers will experience a 15% CAGR in U.S. power demand from 2023-2030. AI data centers – which were essentially non-existent a few years ago – will consume 8% of all US power generation by 2030, and will be the largest contributor to overall US power demand increases over that timeframe2. Copper, aluminum, nickel, lithium, tantalum and other critical minerals will play a central role in supporting this generational surge in power demand.

To their credit, governments and policymakers are recognizing the need to secure access to the critical and strategic minerals and metals to power their economies and the energy transition in the years ahead. They are also taking action, passing over $1.87tn new energy transition infrastructure programs like the U.S. Bipartisan Infrastructure Law, the European Green Deal, the Strategic Innovation Fund in Canada, and the Critical Minerals Facility in Australia, all of which contain at least some provisions meant to address critical mineral security. But will these efforts be as effective as intended?

Diversifying and building resiliency into the critical mineral supply chain

It’s important to understand the marketplace for critical minerals is by no means monolithic. Each commodity and supply chain has its own dynamic and challenges, and different specific solutions are often required to ensure unimpeded access to reliable sources of supply.

While critical minerals like lithium, nickel and cobalt tend to get headlines for their use in solar and EV batteries, many other metals are considered critical due to supply concentration. Smaller-scale commodities that play an equally important role in support of critical mineral security – such as rare earth elements (REEs) – experience a very different set of market dynamics. There are fewer operating REE mines in these metals so the market is small and new mines can have a material impact on absolute volumes of supply available.

The Western world’s reliance on REEs for its technological and defense capabilities has long been overshadowed by a harsh geopolitical reality: China controls almost 80% of global production3. There is only one active rare earth metals mine in the United States – and just a handful of others in the Western hemisphere. This concentration creates more price volatility.

In obvious and practical terms, critical mineral security for REEs means diversifying supply concentration and developing alternative sources of supply, processing, and refinement. But developing them isn’t simple. While there are ample identified REE mineral resources in Western countries – i.e., potential mine sites – downstream REE refining and processing facilities are extremely limited, despite the knowledge and capabilities to do so were originally developed in the U.S.

REEs tend to bind together in mineral form, making them difficult to refine and process. As a further complication, they are most often processed from ore containing the radioactive elements uranium and/or thorium. In other words, it’s not enough to invest in the development of a rare earth mine (which, with few exceptions the West has neglected to do for a generation), you also must develop the human resources, engineering skillsets, operational know-how, and processing facilities – infrastructure and professionals with the capability and knowledge needed to convert mine output into a usable form. This knowledge base needs to be retained and sustained

Put another way, Western nations need to build “mining muscle memory” to support security objectives for critical minerals.

The Paradox of Strong Future Demand and Weak Current Prices

After a sustained period of significant mining underinvestment in the last decade, large supply and demand imbalances are exacerbating critical mineral demand trends: Approximately $130B in annual capex is now needed to support demand projections4.

Mining demand is predictable by population growth and the emerging trends discussed above; mine planning, operational costs, and development timeframes are also generally understood. The major variable in mining investment decisions is the commodity price.

It’s important to note that in some ways, current underinvestment in mining can be seen as a “rational” reaction to low commodity prices. Private capital needs an “incentive price” to deploy capital to build new projects: Investors need to reasonably believe there will be a profitable market for the output of the mines they are building. When a disconnect exists between the perceived future demand and the current commodity price, it creates ongoing underinvestment and subverts the development of mines and mining knowledge. Public equity markets sit on the sidelines as well – share prices are too low.

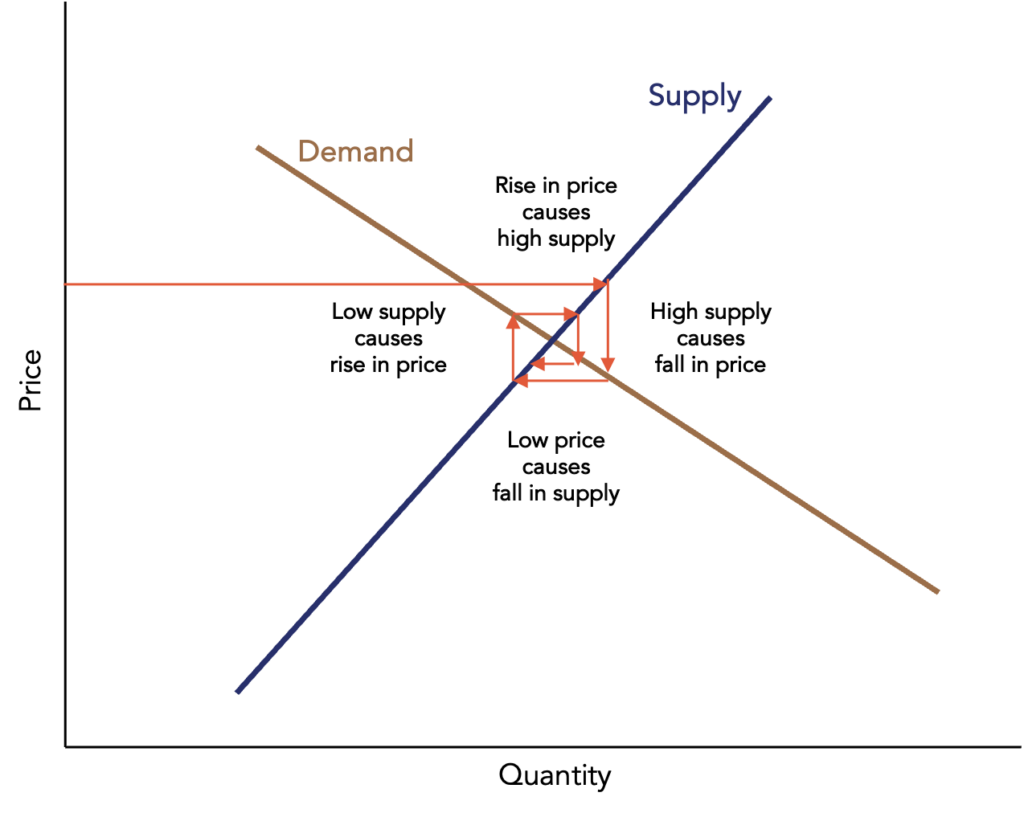

Today’s relatively low REE commodity prices may be explained – at least in part – by the cobweb model of supply and demand5. The quantity supplied by producers depends on prices in previous production periods, and there’s a time lag between a price signal and the ability to produce new product to satisfy demand. For agricultural commodities the dislocations are moderated by the fact that new supplies (e.g., of grain or pork bellies) take just a few months to bring to market. But in mining, dislocations are amplified because once prices start to rise, it takes several years to bring a new mine to market. And, as noted above, price volatility is amplified due to supply concentration of small market commodities.

Figure 1: Cobweb Model

While most economists who follow the industry are expecting sharp rises in demand across multiple mined commodities, absent a price incentive, private sector investment may be limited.

Direct Government Investment is Welcome, but May Not be Enough

The prevailing government approach to increasing critical mineral supplies involves underwriting new mine projects through direct equity investment, grants, loans and loan guarantees and similar means. These are important and necessary in many cases but are only a part of the larger solution required, because direct investment doesn’t impact markets in ways that move private sector capital off the sidelines. Policymakers need to consider additional methods that can better align private sector goals with government’s strategic objectives of increasing long-term access to critical mineral supplies and processing capabilities.

Furthermore, direct investment in mines may not be the best way to overcome geopolitical risks to smaller commodity markets – especially in cases where there is a sovereign player with the aspiration and ability to protect its controlling market share.

Figure 2 demonstrates a real-world example of the REE commodity index and a REE mining company share price performance pre and post direct government funding. Despite the government’s important investment, correlation between the mining company’s share price and the commodity price remains– and the mining company’s share price keeps falling. Where then does the equity come from to build the mine?

The current REE price is less than the cost of production, making an investment in Mining Company A uneconomical. While sophisticated mining investors form views of commodity prices over timeframes of 3-5 years, forecasts in smaller more opaque markets are more complicated. If investors had a clearer view on future commodity prices, equity may come in to support new mine development in these small markets.

Figure 2: Rare Earth Index Price and Rare Earth Mine B Share Price

Governments need to consider strategies that can counter this type of geopolitical risk and encourage an incentive price that overcomes the gap between perceived future demand and currently deflated prices.

Underwriting Commodity Price Risk: Creating Price Floors for Select Mining Projects

Governments that want to bring new critical mineral supplies online should address the root cause of mining underinvestment by focusing on the contingent risk of future commodity prices. In other words, instead of committing to a fixed investment, commit to supporting a price floor: underwrite future prices of specific projects to make mines or investors whole when prices dip below a specific price point.

With contingent price support, governments can remove the largest risk and variable in mine development and ongoing operations – commodity prices – thereby incentivizing private sector capital and debt. In essence, governments are lending their balance sheet to support project development on a contingent basis – and depending on where commodity prices go, that support may end up costing nothing.

Done properly – with select commodity projects, chosen in concert with the private sector – it will create more certainty in the marketplace, incentivizing risk-sharing and inflows of private capital. Underwriting the commodity price evens-out cyclicality. It helps remove the inherent commodity price risk that can impede mine development; in turn, which encourages planning – and capital commitment – for the long-term. It also helps build and maintain “mining muscle memory.” Mining executives and investors who know how much they’ll be able to sell their product for – even 7-10 years down the road – are far more likely to invest the capital and resources required to complete mineral extraction and processing projects. The same market certainty will encourage equity and credit to participate in these development projects.

Committing to a price floor can make taxpayers’ dollars go further, most obviously because there’s no need to provide upfront capital investment. And once production starts, if the spot price is above the price floor, the government won’t need to provide any capital. But even if occasional price downturns trigger support, the overall cost would likely still be lower compared to direct investment.

Potential elements of a critical commodity price floor program:

- Highly selective projects Private sector mining experts are best positioned to know which projects will support the mineral security outcomes governments need at a potential level of returns that will attract investors. Governments should work with them to identify these projects, then commit to controlled pricing support.

- Contingent price support There are multiple ways to execute the strategy: In one scenario, the producer would have the option to sell output at predetermined support price to the government if and when the spot price falls below that threshold. Or, like the USDA Dairy Price Support Program, the government could make direct payments to the producer to compensate for sales beneath the support price.

- Prevent infinite exposure Governments don’t need to – and shouldn’t – commit to eliminating all price risk for the life of the mine; rather they should provide clearly defined time and/or production quantity limits to their support and cover private sector debt participation in the project. As long as the aggregate total of promised support eliminates a substantial portion of the investment risk, private capital will flow in.

- Stockpiling may be natural outgrowth If prices fall during a period of low demand – or if a dominant producer tries to undermine a protected entrant by flooding the market with sub-production-cost output – governments may provide indirect price support by buying that product to stockpile. However, governments also need to be cognizant of how reselling stockpiles can cause volatility and disruption to commodity markets, so resell approaches must be considered carefully.

Who Benefits?

While there is a potential cost in committing to market-building price supports, for certain low-volume commodities the cost will be lower than other methods of securing critical mineral access. And, benefits would be realized by stakeholders throughout the economy:

- Governments: Compared to direct investment, reduced up front exposure, limited overall capital risk, and greater likelihood of addressing geopolitical risks and critical mineral policy

- OEMs: Reduces price volatility and gives manufacturers greater certainty on sources of supply, with better ability to control costs by reducing disruptions.

- Consumers: Eliminates or minimizes bottlenecks in the supply chain which can lead to end-product shortages and inflation.

- Mining Industry: Creates greater certainty for miners to properly plan, hire, and build for ongoing mining operations. It also allows the industry to develop and retain knowledge in building and operating these unique operations.

- Private Sector Investors: Can reliably invest in markets with potential upside and returns for their stakeholders, while supporting critical mineral security and decarbonization efforts

Conclusion

In an era of diminishing globalism and economic realignment, governments increasingly recognize the importance of securing access to the critical and strategic minerals needed to transition to a more sustainable economy and ensure national security. Combined with demand pressures from AI and other technologies, plus ongoing industrialization of non-western economies, the coming paradigm shift in demand will complicate efforts to achieve critical mineral security. It is a multi-faceted challenge, requiring strategic foresight, innovative solutions, and a balance of public and private investment and collaboration.

While direct government investment in mining projects is useful, the selective underwriting of critical commodity price risk – creating a price floor to minimize volatility and incentivize private capital investment into specific mining projects – could be an additive solution.

This approach offers several advantages. By providing greater certainty, it encourages long-term planning and investment in critical mineral projects. Additionally, it allows governments to allocate resources more efficiently, as upfront capital investment is not required. Moreover, by mitigating price risk, it incentivizes the private sector to invest in profitable mining projects. To implement such a strategy effectively, governments must work with sophisticated mining industry and finance experts to select the right projects, while governments provide contingent price support and establish clear limits on exposure.

Some economists will decry such interventions as a form of political interference in the functioning of markets. However, governments are already enacting interventionist policies to build critical mineral capabilities – and in some cases, forestall rival efforts to do so. A well-designed commodity price floor program can mitigate geopolitical risks and help governments leverage private mining capital more effectively to achieve strategic goals, with the aim of ensuring the long-term security and sustainability of critical mineral supply chains.

Source of Data

1 IEA, Minerals used in electric cars compared to conventional cars. https://www.iea.org/data-and-statistics/charts/minerals-used-in-electric-cars-compared-to-conventional-cars

2 Goldman Sachs, Generational Growth: AI, data centers, and the coming US power demand surge, April 2024

3 The Conversation, What are rare earths, crucial elements in modern technology? 4 questions answered. https://theconversation.com/what-are-rare-earths-crucial-elements-in-modern-technology-4-questions-answered-101364

4 Wood Mackenzie, Does the energy transition start and finish with metals? https://www.woodmac.com/news/opinion/does-the-energy-transition-start-and-finish-with-metals/

5 Economicshelp.org, Cobweb theory. https://www.economicshelp.org/blog/glossary/cobweb-theory/

Important Information

This information should not be deemed to be a recommendation of any specific commodity, company, or security. This material is provided for educational purposes only and should not be construed as research. The information presented is not a complete analysis of the energy transition and/or commodities landscape. The opinions expressed may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Resource Capital Funds and/or its affiliates (together, “RCF”) to be reliable. No representation is made that this information is accurate or complete. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

None of the information constitutes a recommendation by RCF, or an offer to sell, or a solicitation of any offer to buy or sell any securities, product or service. The information is not intended to provide investment advice. RCF does not guarantee the suitability or potential value of any particular investment. The information contained herein may not be relied upon by you in evaluating the merits of investing in any investment.

Investing involves risk, including possible loss of principal.