Note: Metric tonnes (t) used in this article.

No metal is more important to human progress than copper. For millennia, copper has underpinned human civilization. From the tools, ornaments, and weapons that lifted mankind out of the Stone Age to the printing presses and steam engines of the industrial revolution to the circuit boards and computer chips of modern technology, it has played a vital role in human progress for at least 70 centuries.

Today, its versatility makes it ideal for use in a wide variety of industries, including medical, electronic, automotive, and aerospace2. While more iron and aluminum are mined each year, copper has the highest primary production rate of any mineral, relative to the amount contained in the earth’s crust1. In other words, copper is being mined faster than any of the other metals that humanity depends on, before above ground recycling flows are considered.

As the world moves toward cleaner forms of energy, copper’s role is set to get even bigger. Thanks to its unmatched electrical and thermal conductivity by geological availability, copper is the cornerstone of the renewables-based economy, an essential component of wind and solar farms, batteries, and high-speed trains, and electric vehicles. The demand for copper for electric vehicles alone is expected to increase by 1.7 million tonnes (Mt) by 20273.

But even today’s high rates of production may not be enough to meet near-future demands. A 2022 report from S&P Global concludes that global demand may increase from 25Mt today to about 50Mt by 2035, but currently projected supply will only be enough to meet 80% of our needs4. As nations fight climate change and race to reduce carbon emissions by 45% by 2030 and reach net zero by 2050,5 copper’s future role will be critical. Growing demand and supply imbalances are creating attractive opportunities for investors.

History of Copper

Beginning as late as 5,000 BCE and possibly as early as 8,000 BCE, copper became one of the first—if not the first—metal used by humans and has been helping civilization progress ever since. It was originally used in what is now the Balkans, the Middle East, and the Near East, but its use spread rapidly from the 2nd millennium BCE after metalworkers learned how to smelt it using charcoal furnaces.

The Copper, or Chalcolithic, Age gave way to the Bronze Age, which lasted roughly from 3300 BC to 1200 BC. Copper, when alloyed with arsenic, antimony, or tin, makes bronze, at the time the hardest and most durable metal known to man. Cultures that produced it enjoyed a huge technological advantage. Its use was associated with increasingly complex social structures, advanced architecture, and organized warfare. Copper and copper-alloy coins became popular around the late 4th century BCE.

By the middle of the first millennium CE, copper was widely used throughout Asia, Africa, Europe, and Mesoamerica for jewelry, tools, figurines, and as a medium of exchange. In 1440, Johannes Gutenberg built his famous Gutenberg Press using copper, along with bronze and brass, both copper alloys, stimulating demand for copper across Europe as the printing press grew in popularity.6

In 1886, France gave the United States the Statue of Liberty; at the time, it had the highest weight of copper in a single structure.6 Copper was probably chosen as the primary metal for its durability, strength, and malleability, which enabled it to be pounded into sheets just 2.4mm thick, about the width of two pennies7, and worked into complex shapes.

As electricity became widespread, copper became increasingly important for industrial and technological uses. In 1914, it was adopted as the international standard of 100% electrical conductivity.8 In 1940, as the demand for electrical wire and cable exploded, continuous wire rod casting technology was developed, allowing exponentially bigger copper coils to be produced.

With the rise of home computing in the 1980s, copper found its way into circuit boards and later, telecommunications cables and DSL broadband. In 1997, IBM introduced the first computer chip to use copper wires.8 Since then, copper has become an essential part of the electric vehicle revolution.

Copper Deposits

There are three primary types of copper deposits:

Volcanogenic massive sulfide (VMS) deposits 9,10

Formed millions or billions of years ago, VMS deposits are rich in copper, lead, and zinc. There are over 900 of them around the world. Because they are rich in more than one metal, they can reduce the cash cost profile for mining companies. VMS deposits generally range in size from 4Mt to 25Mt (with a few outliers up to 150 Mt) but exhibit grades in the vicinity of 5% for copper, 4% for zinc with <1% lead and potentially gold (less than 1gpt).

Porphyry copper deposits

Porphyry deposits provide over 60% of the world’s copper. Porphyry orebodies are lower grade (typically 0.2% to >1% copper) than VMS orebodies but massive in scale ranging from 100Mt to 5,000Mt, allowing for economies of scale.11

As the most easily accessible, high-grade zones (areas with the greatest concentration of copper) have all been mined, copper ore grades have fallen significantly from over the past several decades from 1% to less than 0.6% today.

Sedimentary copper deposits

Sedimentary copper accounts for approximately 25% of the currently known copper resources globally. As the name suggests the deposits are hosted in sedimentary rocks or basins. The resulting ore bodies may be stratabound and either massive or disseminated. The Central African Copper Belt is a classic region hosting numerous sedimentary copper deposits11.1.

Product Forms

Metal

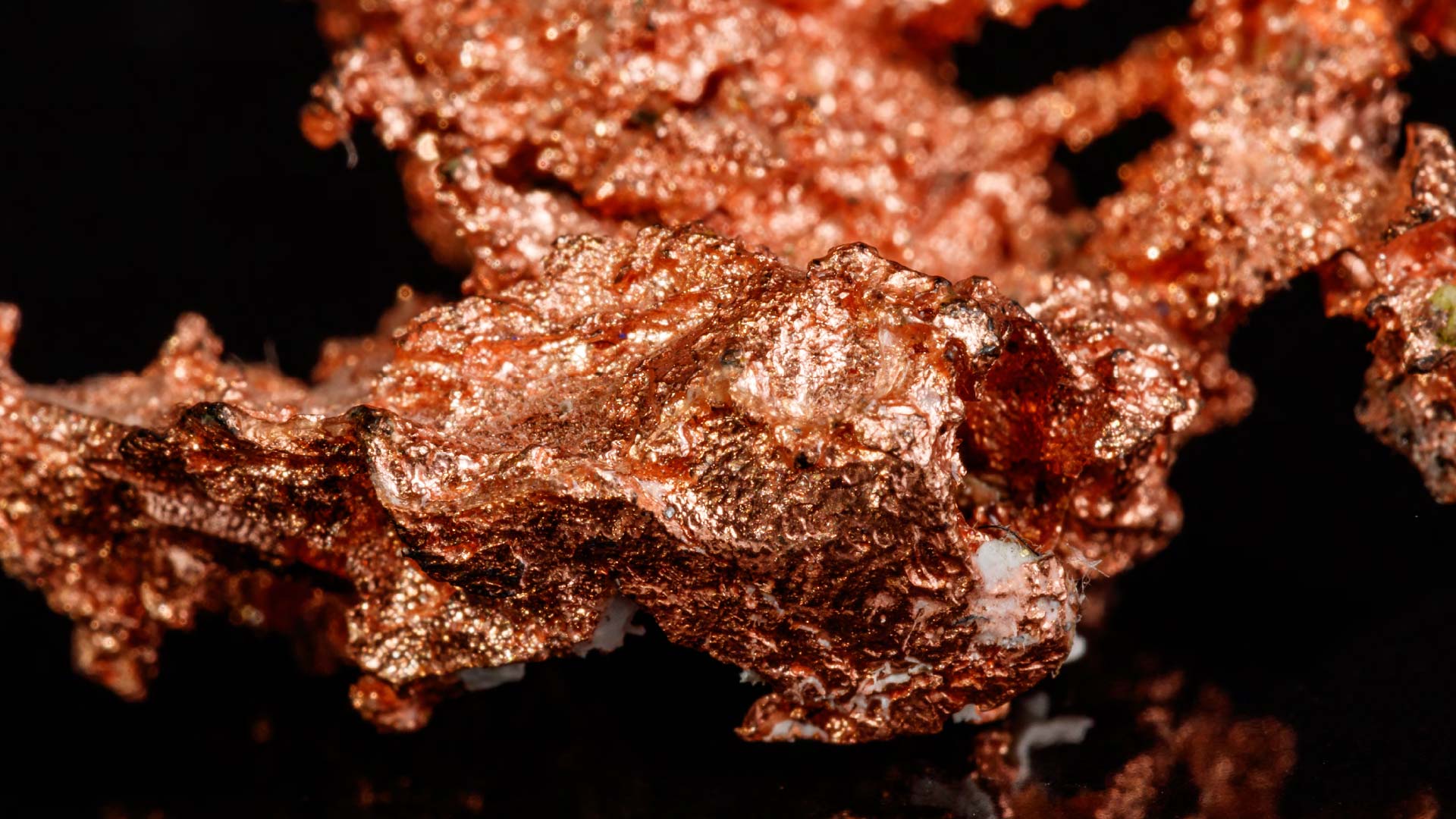

Copper sometimes occurs in pure form but is more often found as an element in minerals, chalcopyrite, and chalcocite in particular.14 Copper minerals are divided into five groups:

- Native Copper: pure copper

- Sulfides: copper in combination with sulfur

- Oxides: copper in combination with oxygen

- Carbonates: copper in combination with carbon and oxygen

- Complex copper minerals: copper in combination with iron, nickel, cobalt, lead, zinc or silver, and other elements15

Pure copper (99.9% Cu) is classified as either oxygen-free high-conductivity copper (OFHC) or electrolytic tough pitch copper (ETP).16 When exposed to water and air, copper undergoes gradual corrosion, leading to the formation of a greenish-blue copper carbonate commonly observed on roofs and statues. This patina acts as a protective layer, preventing further corrosion.17

Alloys

Copper can be combined with a wide variety of other metals to create alloys with a variety of unique properties and applications. Following are a few of the most common:

Brass

The term brass describes a family of copper-zinc alloys that can achieve different mechanical, thermal, and corrosion-resistant properties depending on the proportions of each metal. Typically, brass is at least 63% copper. Brasses with higher copper content are softer and more malleable, while those with more zinc are harder.18

Bronze

Historically, bronze has been an alloy of copper and tin, but it can also refer to alloys of copper and elements such as aluminum, silicon, and nickel. It is generally around 88% copper.

Cupronickels

Cupronickel, also known as copper-nickel, is an alloy of copper and nickel, often with strengthening agents such as manganese and iron. Typically, cupronickel is 60% to 90% copper. Highly resistant to corrosion by salt water, cupronickels are often used in seawater systems and marine hardware, along with more broadly in the chemical, petrochemical, and electrical industries.18

Nickel Silver

Despite its name, nickel silver does not contain any actual silver. Instead, is it an alloy of copper, nickel, and often zinc, typically at 60%, 20%, and 20% respectively. Like other copper alloys, it has good corrosion resistance. It is also known as German silver, nickel brass, or alpaca.

Copper Substitutes

Aluminum offers the same ampacity (maximum current that a conductor can safely carry) as copper, but it is less conductive and more brittle – reducing its applications and ease of substitution. This means that more aluminum must be used to pass the same current as copper.19

Uses of Copper and Copper Alloys

Uses of Copper

Copper is second only to silver in conductivity20, making it an excellent choice for electrical equipment such as wiring, connectors, and contacts.21 Durable and cost-effective, it is used in architecture, primarily for roofing, and for window and door framing, and structural fixings. Its strength makes it a good choice for pressure vessels, gaskets, and heating and cooling systems. The use of copper has also helped boost the efficiency of semiconductors by 30%.22

Copper is also used in the medical industry, as copper coatings on medical devices serve as antimicrobial surfaces, offering practitioners and patients an extra layer of protection against bacterial and viral infections.23

Uses of Copper Alloys

Copper alloys well with several other metals, most notably zinc, tin, and nickel. Copper alloys are generally strong, conductive, and highly resistant to corrosion. Following are some of the most commonly used alloys:

Nickel Silver

Nickel silver has a wide range of industrial applications due to its unique properties. Because of its resistance to corrosion in seawater, it is used in shipbuilding. It is also a common material for electrical contacts and connectors due to its excellent conductivity and resistance to oxidation. It is used in marine fittings, optical and photographic equipment,24 and electrical and telecommunication relays.25 In addition, its acoustic properties make it a good choice for some musical instruments, including French horns and flutes.

Brass

Brass, an alloy of copper and zinc, is a versatile material with a wide range of industrial uses. More malleable than pure copper or zinc, brass is a popular choice for the manufacture of items such as locks, gears, and bearings. Brass is also commonly used for the production of ammunition casings, as it has excellent corrosion resistance and can withstand high temperatures.26 Finally, brass is particularly prized in the manufacturing of musical instruments due to its superior acoustic properties.

Bronze

Bronze is a strong, durable material that can withstand heavy loads and high temperatures, making it ideal for use in machinery and equipment. Because it is highly resistant to corrosion in saltwater environments, it is often used for marine hardware,27 such as propellers, rudders, and shafts, and it is widely used for springs and bearings.28

How and Where is Copper Mined?

Where is Copper Found?

Chile is the top producer of copper, contributing 27% to the world’s supply, and home to the two largest copper mines, Escondida in the Atacama Desert in Northern Chile, and Collahuasi in Tarapaca.29

Other major producers of copper are Peru, China, the Democratic Republic of Congo, Indonesia, Panama, and the United States.30 There are also copper operations in Saudi Arabia, and Zambia, with upcoming expansion operations via the reconstituted Reko Diq mine in Pakistan.

Current known worldwide copper ore resources are approximately 2,630Mt, of which only about 317Mt, or 12%, have been mined throughout history.31 The following countries have the largest reserves32:

- Chile: 200Mt

- Australia: 83Mt

- Peru: 77Mt

- Russia: 62Mt

- Mexico: 53Mt

How Much Copper is Mined?

The amount of copper mined has been growing steadily in line with global GDP. In 2022, 22Mt of copper were mined worldwide.33 Relative to the amount of crustal endowment (amount of copper in the earth’s crust), the annual primary production rate of copper is the highest of all minerals.1

Mining Process

Copper is usually extracted using open-pit, or opencast, mining, a surface mining technique used when mineral or ore deposits are found relatively close to the surface of the earth. Ore is obtained by drilling holes and blasting rock which is taken to nearby processing sites to be crushed further. The crushed ore is then subjected to further processing which depends on the type of ore mined.

There are Two Main Types of Copper Ores

Copper Oxide Ores

Copper oxide ores are generally processed using hydrometallurgy, a water-based process used to extract and purify copper from copper oxide ores at ordinary temperatures. This process involves heap leaching, solvent extraction, and electrowinning. Heap leaching involves stacking the ore into large piles and spraying them with a weak acid solution that dissolves the copper. The copper-rich solution is then collected and treated to remove impurities, leaving behind pure copper.34

Copper Sulfide Ores

Copper sulfide ores, on the other hand, are generally processed using pyrometallurgy. This involves the application of heat to extract and purify copper from copper sulfide ores in four basic steps: froth flotation, thickening, smelting, and electrolysis. Froth flotation is the first step, where chemicals are used to separate the copper from other minerals in the ore. Then, the copper concentrate is thickened and sent to a smelter where it is melted and purified further. Finally, electrolysis is used to produce high-purity copper that is ready to be used in a variety of applications.34

Major Copper Mining Companies*

Large Shifts in Copper Demand

The move into EVs is already a source of significant growing demand: copper is a key component used in the electric motor, batteries, and wiring, as well as in charging stations. While conventional cars use 8-45 kilograms of copper (18–99 pounds), electric vehicles contain up to 83 kilograms (183 pounds).35 Longer-term – and more broadly – demand will be further accelerated by global decarbonization efforts and the green energy transition, because clean energies such as wind, solar, and hydro rely heavily on copper36:

- A single 3-megawatt wind turbine contains up to 4.7t of copper

- Onshore wind farms use approximately 3.5t of copper per MW of generation capacity

- Offshore wind installations use significantly more: 9.55t of copper per MW.

- Solar power systems can contain approximately 5.5t of copper per MW.

It is projected that 262 GW of new solar installations between 2018 and 2027 in North America alone requires 1,441,000t of copper.

Given the fact that there’s no economically viable substitute for copper in EVs, wind, and solar energy, achieving global decarbonization goals will require a significant increase in the production of copper. S&P forecasts that by 2035, refined copper usage for decarbonization alone will reach 20 million tons per annum (Mtpa). That equals all the copper mined around the world in 2020 . With decreasing yields from existing mines and relatively few new projects coming on line, analysts foresee a supply shortfall starting in 2025. Absent significant added capital investment, the gap between projected usage and supply could reach 31 Mt by 2050.

Figure 1: Energy Transition Copper Demand

Figure 2: Copper Inventory vs. Price Dislocation

Copper & ESG

As with all forms of economic activity, there are Environmental, Social, and Governance (ESG) issues inherent in copper mining. Open-pit mining, the most common form of extraction for copper, entails significant land and water use, along with removal of topsoil and vegetation. However, with proper mine closure planning, these impacts can be mitigated. And while copper production has been associated with high energy use and significant carbon emissions, copper is also essential to the green-energy transition: global decarbonization targets cannot be met without considerable increases to copper supplies.

Mine operators need to respond proactively to manage impacts on communities. A “Social License to Operate” – i.e., the acceptance of local communities beyond what is required by legal or regulatory processes – is important to many companies who have developed and implemented ESG management procedures that go beyond what is foreseen by regulations.38 As an example, 13 copper mining companies in Chile have made a voluntary commitment to reduce greenhouse gas emissions as part of the country’s local and global targets.39 Producers such as BHP are also investing more in recycling and producing “green” copper reclaimed from waste streams. And a growing number of stakeholders are committing to the responsible copper production practices defined by The Copper Mark.40

Copper Investment Opportunities

The opportunity in copper investment has arguably never been better. Copper is one of the most widely used metals in the industrial sector, and its demand typically increases during times of economic expansion. This makes investing in copper a potential hedge against inflation and other broad economic factors that may cause volatility in the market.41

Selective investing in junior to mid-tier mining companies with good assets offers attractive potential upside, relative to large publicly traded companies, ETFs, or commodities trading. There are still undervalued junior and midcap miners in tier 1 jurisdictions (those with large deposits, long production life, and relatively low extraction cost), but being able to identify the better prospects takes expertise and feet-on-the-ground inspection. Again, this is an area where it pays to partner with experienced managers who understand both the market and the technical issues involved.

Like what you’re reading? Subscribe to our top stories.

Source of Data

1 USGS data

2 Kenmode, Why Copper is Ideal for Industrial Use. https://www.kenmode.com/blog/why-copper-is-ideal-for-industrial-use

3 Copper Development Association Inc., Copper Drives Electric Vehicles. https://www.copper.org/publications/pub_list/pdf/A6191-ElectricVehicles-Factsheet.pdf

4 IHS Markit now part of S&P Global, The Future of Copper. https://cdn.ihsmarkit.com/www/pdf/0722/The-Future-of-Copper_Full-Report_14July2022.pdf

5 United Nations, For a liveable climate: Net-zero commitments must be backed byt credible action. https://www.un.org/en/climatechange/net-zero-coalition

6 Copper Development Association Inc., A Timeline of Copper Technologies. https://www.copper.org/education/history/timeline/timeline.html

7 National Park Service, Get the Facts. https://www.nps.gov/stli/planyourvisit/get-the-facts.htm

8 Copper Development Association Inc., A Timeline of Copper Technologies. https://www.copper.org/education/history/timeline/timeline.html

9 Mining.com, Everything you need to know about VMS deposits. https://www.mining.com/web/everything-need-know-vms-deposits/

10 911Metallurgist, VMS Volcanogenic Massive Sulphide Ore Deposits & Mineralization. https://www.911metallurgist.com/blog/vms-volcanogenic-massive-sulphide-deposits-ore-mineralization#:~:text=It’s%20nice%20to%20say%20that,which%20is%20150%20million%20tonnes

11 Visual Capitalist, Everything You Need to Know About Copper Porphyries. https://www.visualcapitalist.com/everything-you-need-to-know-about-copper-porphyries/

11.1 USGS, Copper—A Metal for the Ages. https://pubs.usgs.gov/fs/2009/3031/FS2009-3031.pdf

12 Royal Society of Chemistry, Copper. https://www.rsc.org/periodic-table/element/29/copper

13 Periodictable.com, Van Der Waals Radius of the elements. https://periodictable.com/Properties/A/VanDerWaalsRadius.v.html

14 Minerals Education Coalition, Periodic Table of the Elements: Copper. https://mineralseducationcoalition.org/elements/copper/

15 University of Waterloo, Copper. https://uwaterloo.ca/earth-sciences-museum/resources/detailed-rocks-and-minerals-articles/copper

16 ScienceDirect, Electrolytic Tough-Pitch Copper. https://www.sciencedirect.com/topics/engineering/electrolytic-tough-pitch-copper

17 Coppersmith Creations, Understanding Copper Patina/Corrosion. https://www.coppersmithcreations.co.uk/understanding-copper-patina-corrosion/

18 Wikipedia, Brass. https://en.wikipedia.org/wiki/Brass

19 IEWC, Copper Conductor Alternatives. https://www.iewc.com/resources/educational-resources/copper-alternatives

20 Nuclear Power, Copper Alloys. https://www.nuclear-power.com/nuclear-engineering/metals-what-are-metals/alloys-composition-properties-of-metal-alloys/copper-alloys/

21 Chemicool, Copper Element Facts. https://www.chemicool.com/elements/copper.html

22 Copper Development Association Inc., Innovations – Introduction to Copper. https://www.copper.org/publications/newsletters/innovations/2001/08/intro_to_copper.html

23 National Library of Medicine, Metallic Copper as an Antimicrobial Surface. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3067274/

24 Copper Development Association Inc., Nickel Silvers. https://www.copper.org/resources/properties/microstructure/ni_silver.html

25 Britannica, Nickel silver. https://www.britannica.com/technology/nickel-silver

26 Geology.com, Uses of Copper. https://geology.com/usgs/uses-of-copper/

27 Wikipedia, Bronze. https://en.wikipedia.org/wiki/Bronze

28 Nuclear Power, Copper Alloys. https://www.nuclear-power.com/nuclear-engineering/metals-what-are-metals/alloys-composition-properties-of-metal-alloys/copper-alloys/

29 Mining Technology, The world’s ten largest copper mines. https://www.mining-technology.com/marketdata/ten-largest-coppers-mines/

30 World Economic Forum, Which countries produce the most copper? https://www.weforum.org/agenda/2022/12/which-countries-produce-the-most-copper/

31 Copper Development Association Inc., Copper – the World’s Most Reusable Resource. https://www.copper.org/environment/lifecycle/g_recycl.html

32 Investing News Network, Copper Reserves: Top 5 Countries (Updated 2023). https://investingnews.com/daily/resource-investing/base-metals-investing/copper-investing/top-copper-reserves-country/

33 Statista, Total copper mine production worldwide from 2010 to 2022. https://www.statista.com/statistics/254839/copper-production-by-country/

34 The University of Arizona, Superfund Research Center, Copper Mining and Processing: Processing Copper Ores. https://superfund.arizona.edu/resources/learning-modules-english/copper-mining-and-processing/processing-copper-ores#:~:text=Copper%20mining%20is%20usually%20performed,blast%20and%20break%20the%20rock

35 Copper Development Association Inc., How Copper Drives Electric Vehicles (Infographic). https://www.copper.org/publications/pub_list/pdf/A6192_ElectricVehicles-Infographic.pdf

36 Visual Capitalist, Visualizing Copper’s Role in the Transition to Clean Energy. https://www.visualcapitalist.com/visualizing-coppers-role-in-the-transition-to-clean-energy/

37 U.S. Geological Survey, Mineral Commodity Summaries, Copper. https://pubs.usgs.gov/periodicals/mcs2021/mcs2021-copper.pdf

38 IEA, Latin America’s opportunity in critical minerals for the clean energy transition. https://www.iea.org/commentaries/latin-america-s-opportunity-in-critical-minerals-for-the-clean-energy-transition

39 AZO Mining, Working Towards a Sustainable Copper Mining Industry. https://www.azomining.com/Article.aspx?ArticleID=1647

40 The Copper Mark. https://coppermark.org/

41 Seeking Alpha, How To Invest In Copper: Directly & Indirectly. https://seekingalpha.com/article/4473310-how-to-invest-in-copper

*RCF does not approve or endorse any information provided in the following third-party websites.

Important Information

This information should not be deemed to be a recommendation of any specific commodity, company, or security.

This material is provided for educational purposes only and should not be construed as research. The information presented is not a complete analysis of the copper and/or commodities landscape. The opinions expressed may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Resource Capital Funds and/or its affiliates (together, “RCF”) to be reliable. No representation is made that this information is accurate or complete. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

None of the information constitutes a recommendation by RCF, or an offer to sell, or a solicitation of any offer to buy or sell any securities, product or service. The information is not intended to provide investment advice. RCF does not guarantee the suitability or potential value of any particular investment. The information contained herein may not be relied upon by you in evaluating the merits of investing in any investment.

Investing involves risk, including possible loss of principal.

Contents

Copper Quick Facts12,13

| Melting Point | 1084.62°C, 1357.77 K |

|---|---|

| Boiling Point | 2560°C, 2833 K |

| Density | 8.96 g/cm3 |

| Moh's Hardness | 3.0 |

| van der Waals radius | 140 pm |

| Ionic Radius | 91 pm |

| Isotopes | Copper has 24 isotopes whose half-lives are known, with mass numbers 57 to 80. Naturally occurring copper is a mixture of its two stable isotopes, 63Cu and 65Cu, with natural abundances of 69.2% and 30.8% respectively. |

| Color | Reddish orange, soft, metallic luster. When exposed to air and moisture, copper gradually tarnishes to a dull, greenish color. |