Resource Capital Funds investment committees and market teams meet regularly to review and assess the mining cycle for individual commodities. We use proprietary assessments and stochastic modelling driven by internal and external analytics, informed by extensive market research and commodity-specific trends.

When assessing cyclicality in mining, we start by understanding that the commodity marketplace is not homogeneous. This approach ensures that the metals and mining marketplace always remains investable. Extensive research and analytics, a disciplined process, and experience allow us to assess each commodity opportunity individually across the overall metals & mining investment environment.

Currently, the larger metals markets—such as gold, copper, and iron ore—are in a very different part of the cycle than battery metals like nickel, cobalt, and lithium. Battery metals have gone through a full crest-and-fall cycle, due to over-investment and competition from China. Given the forecasted demand for battery metals, we see this as a compelling opportunity for contrarian investment.

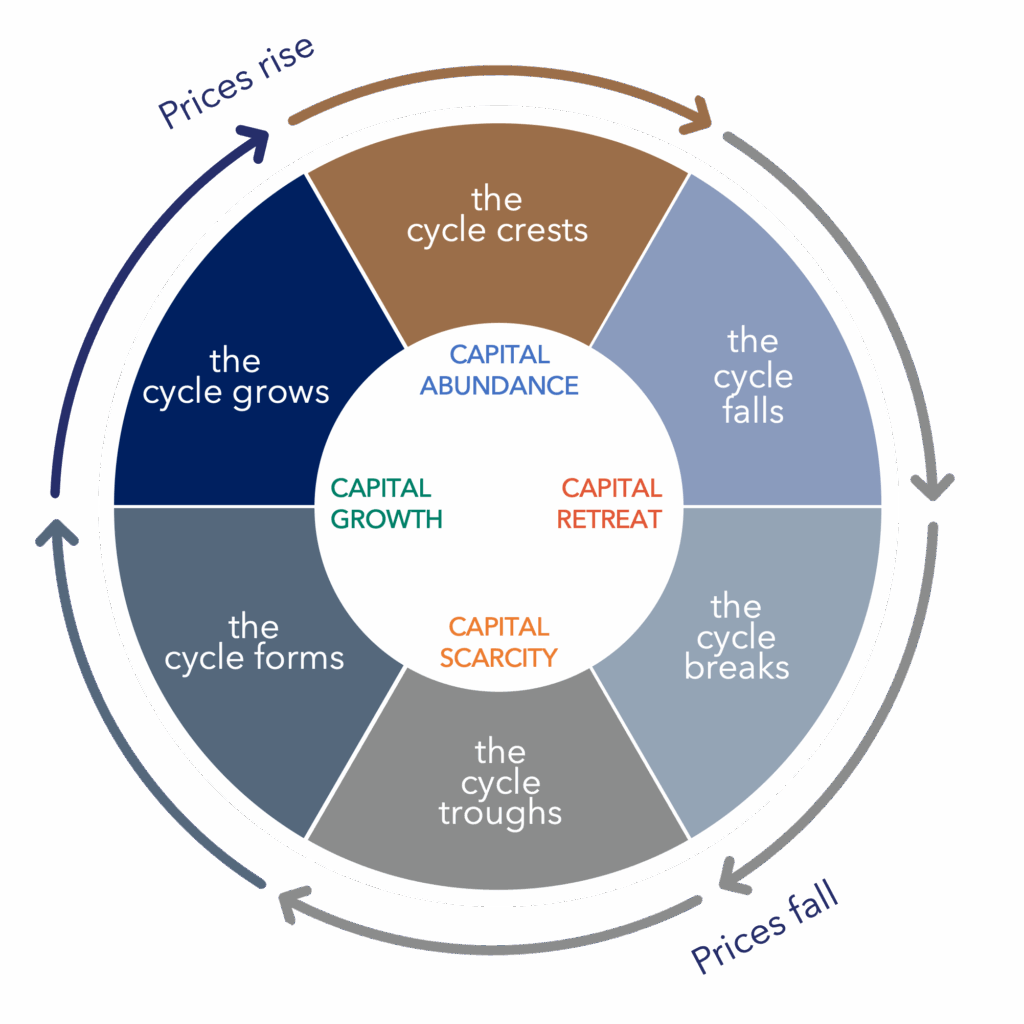

Figure 1: RCF Proprietary Commodity Assessment Model

- Nine indicators used to formulate macro-commodity forecasts and positions

- Evaluates individual commodity investment opportunities

- Regular assessment and review across investment committees and market teams

RCF’s 9 Indicators for Assessing a Commodity Cycle

1. Commodity Demand Indicators

Commodity demand indicators are the signals used to assess current and future demand levels for commodities within the market. They are often influenced by economic, geopolitical, and industrial factors.

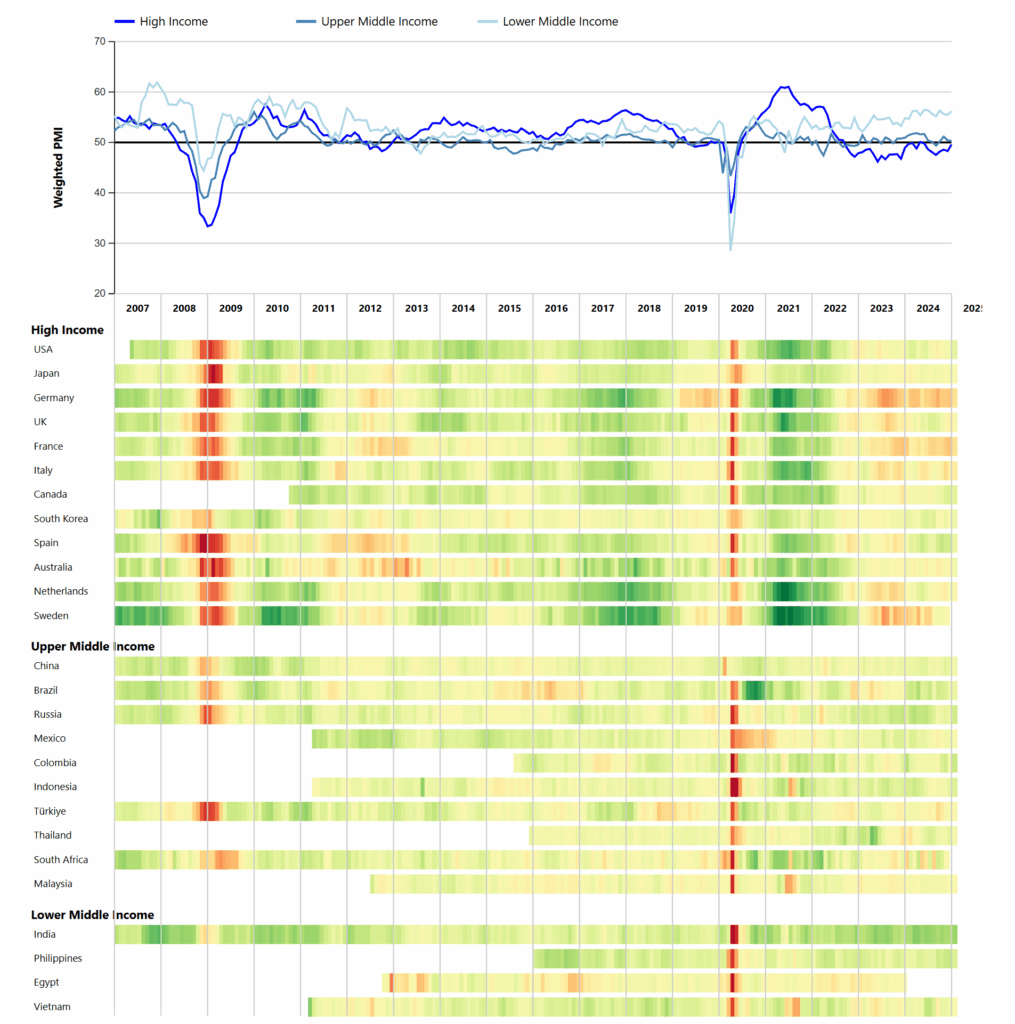

As mentioned above, there is tremendous demand coming from countries with big populations that are proximate to China and are in the process of industrializing, such as India, Indonesia, but also Turkey. We also track industrial production in the US, EU, China, and Japan, as all four markets are incredibly important to commodity demand. It’s not a surprise to see that industrial demand has fallen in these four countries since the highs of 2021, when the world was flooded with stimulus. In the short-term, RCF expects to see some further weakness developing in a higher interest rate environment in high-income countries, but strong manufacturing PMI data from middle income countries is counterbalancing this demand-side impact.

Figure 2: Purchasing Manager Index (PMI) – World

Source: S&P, IHS Markit, RCF Analysis, Mar 2025

2. Supply Side Industry Margins & Cost Curves

Supply side industry margins refer to the difference between the production costs of commodities and their selling prices, i.e., profitability. Cost curves graphically represent the relationship between the cost of producing an additional unit (marginal cost) and the quantity produced. They help us understand how costs, pricing and investment decisions are impacted by changes in output levels.

One way of conceptualizing industry profitability is to compare the commodity price level (revenue) to the production cost of the middle 2 quartiles of the cost curve (cost) to roughly calculate a representative EBITDA margin, and observe how this margin proxy varies over time. In Figure 3, RCF performs this calculation for bulks (iron ore, met, thermal coal;), base metals (aluminium, copper, nickel and zinc) and for gold.

Figure 3: EBITDA Margin – Bulk, Base, & Gold

EBITDA Margin – Bulk Commodities

EBITDA Margin – Base Metals

EBITDA Margin – Gold

3. Commodity Prices

One lens that RCF considers is whether metals & mined commodities are physically and/or financially traded. At times, financial trading (e.g., futures and derivatives) can impact pricing in the physical markets.

In the past few years, RCF observed a curious divergence between commodities that are financially traded and those markets that are predominantly physically traded, as a result of dramatic changes in global money supply. From mid-2020 up until last year, financially traded markets experienced higher highs comparatively, driven by speculation on pending demand that has yet to materialize. These excesses are in the process of unwinding.

When focusing on 2024, the strongest physical markets were those impacted by supply disruptions. These include:

- Alumina and Bauxite (physical disruptions and global input supply tightness)

- Tantalite (related to DRC supply offline due to rebel activity)

In the financially traded markets, both Silver and Gold stand out. Both of these markets remain physically tight, with investment demand driving prices up approximately 30% by year-end, despite being even higher intra-year.

Figure 4: Physical vs. Financial Markets

4. Inventories

Inventories are stored quantities of metal, either in concentrates or value chain buffers (e.g., port stocks) or held in finished form. Additionally, scrap metal can also be thought of as a form of inventory. Inventories are supply buffers, and monitoring their change over time provides indications of whether a commodity market needs further supply-side investment.

Precious, base and bulk metals all have separate inventory dynamics. Precious metals are stored by consumers, investors and governments throughout the world as ‘real assets’ to protect against purchasing power erosion (e.g., inflation), in the form of jewelry, bars & coins, or monetary reserves.

Base metals are held in warehouses or storage facilities managed by major commodity exchanges, industry stakeholders, or governments. These inventories are closely monitored as they provide insight into the balance between supply and demand in the market, affecting prices and signaling potential shortages or surpluses of these essential industrial materials. What’s observable at the close of 2024 are rising exchange inventories, showing high-income country industrial weakness; however, prices remain high.

Figure 5: Copper Example – Gap between Copper Prices & Warehouse Supply

Bulk metals are held in stockpiles, ready to be refined into steel, chemicals, or other industrial inputs to add value throughout global manufacturing value chains.

5. Drilling & Exploration Expenditure

Drilling and exploration expenditure are the funds allocated towards the discovery and assessment of new mineral deposits. It includes the costs of drilling, sampling, and preliminary geological surveys. These investments are critical for identifying viable mining projects and replenishing reserves which together directly impact the future supply of minerals and metals.

Exploration budgets have risen since 2016, but they are nowhere near what they were in the last cycle. Some money is coming in, but it is not enough. Companies quite simply need to invest more to find and economically delineate the mines of tomorrow. It’s important to be aware that gold and copper drive the sector. Out of a total $12 billion in global exploration expenditure, almost $6 billion is spent looking for gold and another $3 billion on looking for copper.

Figure 6: Worldwide Exploration Budgets by Target

Looking at the number of individual projects that are drilling, we again see that gold predominates, with copper in second place. In the last 18 months, drill meters and the number of distinct projects drilled has decreased. Ultimately, that will curtail development opportunities in 5 to 10 years because we are not spending the money today on drilling. Those companies that have already invested in drilling and have some of the more attractive deposits are going to be more valuable given the future supply-side scarcity that the market will suffer.

6. Australian, US, & Canadian Mining Employment

Employment numbers matter, as both a cyclical signal and because people shortages eventually translate into reduced capacity and production. Given that the employment is slightly stronger than mid-cycle right now, it is encouraging to see that the industry is hiring in increasing numbers. Part of this is because we need to replace numbers that we are losing to retirement, but overall fluctuations provide insight into corporate confidence and project pipeline development.

Figure 7: Australia, Canada, and US Mining Employment

7. Valuation

Valuations fluctuate, depending on whether capital is entering or exiting the sector. Taking flows out of it (or setting them to neutral), fundamental valuations are based on factors such as the quantity and quality of mineral reserves, operational efficiency, market demand for the metals it produces, future cash flow projections, and prevailing metal prices. This assessment is crucial for investors, stakeholders, and the company itself to make informed decisions regarding investments, acquisitions, and strategic planning.

Price to Net Asset Value (P/NAV ratio) is a core industry valuation metric. In most cases, the price of a company or asset is less than 1, when adjusted for risk. Risk takes many forms depending on the development stage (explorers, developers, and producers) and is not always negative. It is common for companies to trade above their net asset value (>1) for future growth, management team reputation, and other intangible value reasons.

When looking at the copper sector, it is interesting to note that P/NAV valuations are only trading at their 10-year average, suggesting that nothing is too stretched.

Figure 8: P/NAV for Copper Companies

That said, there has been a big move in Development stage valuations under the surface of the data, as shown below.

8. M&A Activity

M&A activity is another important cyclical signal, which can inform analysts of potential market transitions.

For example, Lithium M&A was extremely active in 2023, particularly in Western Australia, as companies positioned themselves in the high lithium price environment. This year, gold is taking some of that market share relative to lithium, but gold and lithium equities are in a very different cyclical position. In gold, several junior mining companies are realizing that it makes sense to combine, and mergers of equals are taking place for scale and cost reduction. The other big mover in 2024 has been coal, found within the “Others” category below.

Figure 9: M&A Activity by Commodity

9. Capital Flows – Financings

Capital flow is the movement of money for the purpose of investing in mining operations, projects, or companies. This includes the injection of funds from equity investments, debt financing, government grants, and private equity, aimed at exploration, development, and expansion activities. Capital flows are crucial for the growth and sustainability of the mining sector, enabling the discovery, extraction, and processing of minerals and metals to meet global demand.

The mining industry has been suffering from a considerable lack of capital for the better part of a decade. It is most pronounced in senior debt, which is used for the big projects of tomorrow. This lack of financing is one of the reasons we are still not moving across the larger markets, and that is unlikely to change until prices signal capital to come back into the sector.

Public equity still drives the market, but private financing is stepping in. In 2023, the number of metals and mining funds was as high as it’s been since 2016, and private capital now makes up just over 20% of overall funding. The money that is going to go into the sector today is very well placed relative to where the commodity markets in metals and mining are likely to go over the next 5 to 10 years. Private capital will play an important role in funding the industry into the next cycle.

Figure 10: Public Capital & Private Capital Flows

Cyclical & Structural Drivers

While specific commodity markets present investable opportunities no matter overall macro trends, we are in a unique moment.

Wherever you look in the world, we are consuming more metal than ever before in history. We are using far more metals in residential properties than ever before—and that’s before every house is “smart” and has backup battery power at the ready.

Every form of power generation, from nuclear to renewables, is critically dependent on metals and mining. Aside from energy being the master resource and standards of living being measured by how much power individuals or societies can afford to waste, the metals & mining industry underpins it all. Some of the world’s most advanced sectors, economies and even militaries are starting to realize that they have taken metals & mining supply for granted, for far too long.

What remains intriguing is how calm the overall price environment remains, in what should be clear and present signalling that the future metals & mining sector needs to grow. But the longer the wait, the more violent the next wave will be when it comes. Critical minerals and mining exposure as part of a real assets allocation will matter.

Important Information

This material is provided for educational purposes only and should not be construed as research. The information presented is not a complete analysis of the commodities landscape. None of the information constitutes a recommendation by RCF, or an offer to sell, or a solicitation of any offer to buy or sell any securities, product or service. The information is not intended to provide investment advice. RCF does not guarantee the suitability or potential value of any particular investment. The information contained herein may not be relied upon by you in evaluating the merits of investing in any investment.

This presentation includes forward-looking information, and we caution you that such information is inherently less reliable. These statements may not be representative, or may differ, perhaps materially, from future results. Such forward‐looking statements are presented herein for illustrative purposes only.Such forward‐looking statements are inherently unreliable as they are based on estimates and assumptions about events and conditions that have not yet occurred and any of which may prove to be incorrect. In addition, the accuracy of such statements are subject to uncertainties and changes (including changes in economic, operational, political or other circumstances ), all of which are beyond RCFM’s control. There can be no assurance that any such expectations and projections will be attained. RCFM undertakes no obligation to update or revise any forward‐looking statements, whether as a result of new information, future events or otherwise.

This presentation contains commodity specific information; this information is provided as an example only. Each commodity will be subject to its own facts and circumstances which may make it more or less likely to align with the examples provided. This information should not be deemed to be an investment recommendation of any specific commodity, company or security.

The opinions expressed may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by RCF to be reliable. No representation is made that this information is accurate or complete. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Investing involves risk, including possible loss of principal.