RCF closed the prior quarter (Q3 2025) by observing the broadening and deepening of metals & mining investment case, driven by the following factors:

- Energy, Security & Technology demand for metal is accelerating, drawing on inventories and challenging current supply, leading to price increases across most metals

- Higher commodity prices are leading to EBITDA margin expansion, particularly in precious metals, and this has started to generate expanded investor interest in the sector

- Competition for scarce mining assets is increasing, driving supply-side opportunity for investors

- As such, the overall investment environment is growing more positive by the day, for both new investments and precious metals exits going into Q4 2025.

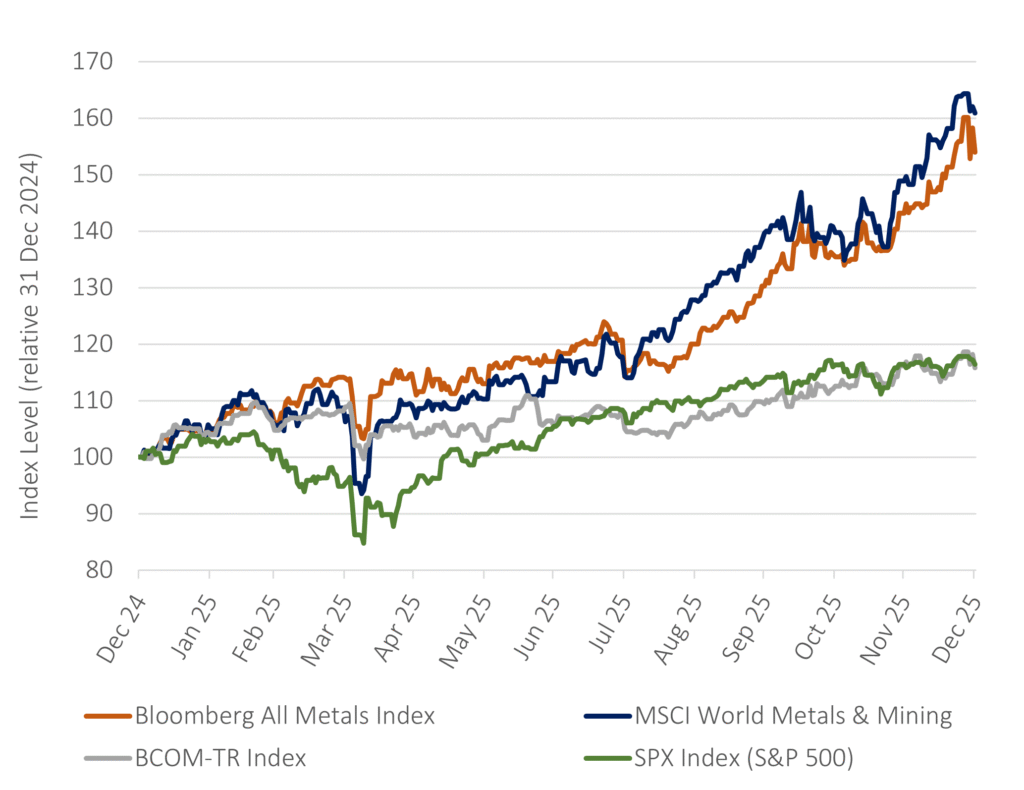

Now that Q4 2025 has closed, here’s the full year picture on the change in metals & mining commodity prices & equities, shown relative to the broader Bloomberg Commodities Index (BCOM) and the S&P 500.

Commodity and Equity Price Indices

Source: Bloomberg data, RCF Analysis, as of 31 Dec 2025

As the chart above shows, metal prices (+54% yoy) and metals & mining equities (+61% yoy) have separated from the broad commodity complex as well as the S&P 500, turning in a very strong year. And now that government and government data releases have resumed in the US, we can start to piece together what happened in the second half of 2025, starting with precious metals.

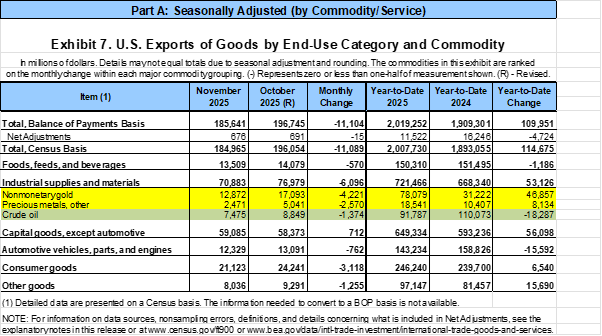

In the latest trade data, we noticed that US precious metals exports ($97B) topped crude oil exports ($92B) over the first 11 months of 2025. This is both noteworthy and somewhat remarkable, given the relative sizes of both markets. Further context, US exports of precious metals ($97B) account for 4.4% of All US Goods Exported ($2T), again over the first 11 months of 2025, with Dec 2025 pending release on 19 Feb 2026.

Source: Exhibit 7 xlsx, https://www.census.gov/foreign-trade/Press-Release/current_press_release/index.html

Zeroing in on gold, the above table shows that the US exported $78B of non-monetary gold in the first 11 months of 2025, 1.5x the value of comparable 2024 exports, with the gold price only up 42%. Price equalized, the US exported >100% of the gold by volume, in the first 11 months of 2025 vs 2024.

The precious metal contribution to US Net Exports is helping to close the trade gap and has had a material impact on Atlanta Fed GDPNow forecasts for Q4 2025. However, a country can only export an existing asset once, and with non-monetary gold exports running at >3x forecast annual US domestic gold production (primary + secondary) in 2025, this international trade statistic equates to a net external transfer of existing US wealth.

To be balanced and fair, the US imported $28B of non-monetary gold in the same period, but 2025 gold imports are about 1/3 of exports. From the data, it is clear a fair portion of US gold held in-use or as a store of wealth has been sold abroad over the year. Accelerating demand for gold outside the USA has now transitioned into adjacent metal markets.

In summary, 2025 closes with both metals and metals & mining equities outperforming the broader commodity complex and the S&P500 by a factor of 3x. Looking forward to the next 5-10 years, RCF is observing rising demand, which is delivering strong incentive prices for new metal & mine supply. However, capital markets and mining companies remain unconvinced that prices will remain structurally elevated over the next 5-10 years, which is what it will take to shift mindsets and precautionary instincts. And with higher new project capex because of post-COVID cumulative inflation, the industry is not sanctioning new projects, yet.

It will take time before higher for longer becomes the accepted base case for boards and investors more broadly. This standoff will likely continue, increasing the opportunity for those already invested and/or increasing exposure to the sector before generalist rebalancing starts to gain pace over the next few years.

Important Information

This material is provided for educational purposes only and should not be construed as research. The information presented is not a complete analysis of the commodities landscape.

Forward-looking statements are presented for illustrative purposes only and are not guarantees of future performance. Actual performance will vary due to a variety of factors, including general economic conditions. Neither RCF nor any independent third party has independently audited or verified this information.

The opinions expressed may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Resource Capital Funds and/or its affiliates (together, “RCF”) to be reliable. No representation is made that this information is accurate or complete. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

None of the information constitutes a recommendation by RCF, or an offer to sell, or a solicitation of any offer to buy or sell any securities, product or service. The information is not intended to provide investment advice. RCF does not guarantee the suitability or potential value of any particular investment. The information contained herein may not be relied upon by you in evaluating the merits of any investment.

References to market, composite, or commodity specific indices, determined by a third party, are provided for informational purposes only. Index information was compiled from sources that RCF believes to be reliable. No representation or guarantee is made hereby with respect to the accuracy or completeness of such data. Reference to an index does not imply that a fund will achieve returns or other results similar to the index. These indices cannot be invested in directly by a fund or other investors. The market volatility, liquidity, concentrations, restrictions and other characteristics of private market investments are materially different from indices, and therefore the indices do not necessarily reflect a basis for comparison with private market investments. The performance of these indices is reported on the gross performance of the underlying assets and does not take into account any fees or expenses that may be associated with investing in those assets. Any attempt to mimic the indices will result in fees and expenses associated with investing and will reduce performance.

Past performance is not indicative of future results. Investing involves risk, including possible loss of principal.