It’s been very difficult to write the Q1 2025 update, when the world changed so dramatically just after the quarter closed on “Liberation Day”. Everyone knows what happened on 2nd April 2025, with investors still wondering what it means for the overall metals & mining investment environment. This will become clearer as the tariff negotiations continue, along with evolving impacts and observable changes in the underlying trade and physical market data. This greater clarity remains forward-looking, for now.

To effectively write this update, it required putting the blinders on and just looking at Q1 2025 developments in isolation from more recent developments, starting with prices.

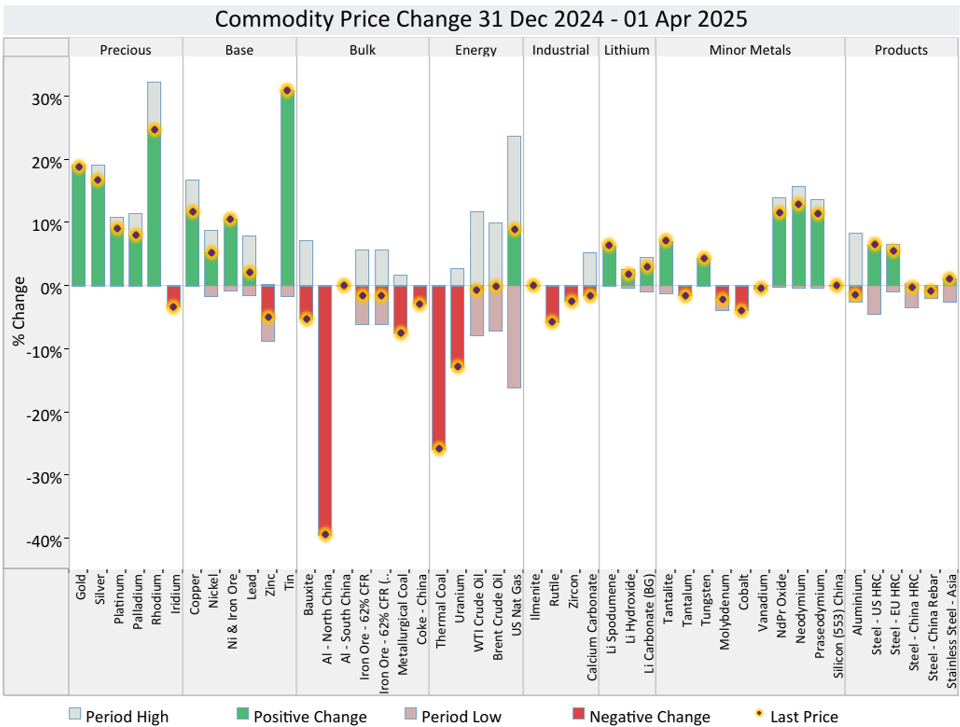

Change in Metals & Mining Prices (Q1 2025 only)

Source: Argus, Bloomberg, FastMarkets and S&P Global data, RCF Analysis, as of 1 Apr 2025

The graph above shows that metals & mining markets remain very healthy, with 10% (or greater) quarterly price gains across many important markets. Prices across precious, base, lithium, rare earths and ex-China steel ended the quarter at the top (or near the top) of their 90-day trading ranges. Gold continues to lead, with price recoveries in other markets providing further sector encouragement, particularly in many future-facing commodities such as copper, tin, and rare earths.

In the middle of the quarter, the RCF investment committees came together at the semi-annual Portfolio, Commodity and Investment Strategy meeting and confirmed our medium & long-term outlooks for the market. The conclusions and insights from this meeting were shared with the RCF LP community on March 19, 2025, accessible here.

The overall outlook remains very positive for private investors in the metals & mining space. Global investment interest continues to grow, as the world seeks refuge in real assets to protect against inflation and to participate in the addition plus relocation of manufacturing activity to new markets. In many cases, these additions and relocations are directed at markets that have been neglected by globalisation for decades.

Therefore, when you hear Secretary Bessent say “….now it’s Main Street’s turn” or wonder how Asia and/or Europe might respond, it is not hard to conclude that the metals & mining industry is a natural beneficiary, arguably the sweet spot, of what is likely to unfold over the next decade.

Important Information

This material is provided for educational purposes only and should not be construed as research. The information presented is not a complete analysis of the commodities landscape.

Forward-looking statements are presented for illustrative purposes only and are not guarantees of future performance. Actual performance will vary due to a variety of factors, including general economic conditions. Neither RCF nor any independent third party has independently audited or verified this information.

The opinions expressed may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Resource Capital Funds and/or its affiliates (together, “RCF”) to be reliable. No representation is made that this information is accurate or complete. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

None of the information constitutes a recommendation by RCF, or an offer to sell, or a solicitation of any offer to buy or sell any securities, product or service. The information is not intended to provide investment advice. RCF does not guarantee the suitability or potential value of any particular investment. The information contained herein may not be relied upon by you in evaluating the merits of any investment.

References to market, composite, or commodity specific indices, determined by a third party, are provided for informational purposes only. Index information was compiled from sources that RCF believes to be reliable. No representation or guarantee is made hereby with respect to the accuracy or completeness of such data. Reference to an index does not imply that a fund will achieve returns or other results similar to the index. These indices cannot be invested in directly by a fund or other investors. The market volatility, liquidity, concentrations, restrictions and other characteristics of private market investments are materially different from indices, and therefore the indices do not necessarily reflect a basis for comparison with private market investments. The performance of these indices is reported on the gross performance of the underlying assets and does not take into account any fees or expenses that may be associated with investing in those assets. Any attempt to mimic the indices will result in fees and expenses associated with investing and will reduce performance.

Past performance is not indicative of future results. Investing involves risk, including possible loss of principal.