10 days into Q3 2025, the transformative US Department of Defense (DoD) investment in MP Materials was announced and everyone in the critical minerals and metals & mining investment world immediately noticed. The MP Materials transaction marked a pivotal shift in the critical minerals landscape, accelerating America’s push for rare earth independence and reshaping global supply chains. The transaction was completed in eight weeks, at ‘warp speed’ according to insiders, and it has changed everything in terms of government intervention to achieve economic security within the United States.

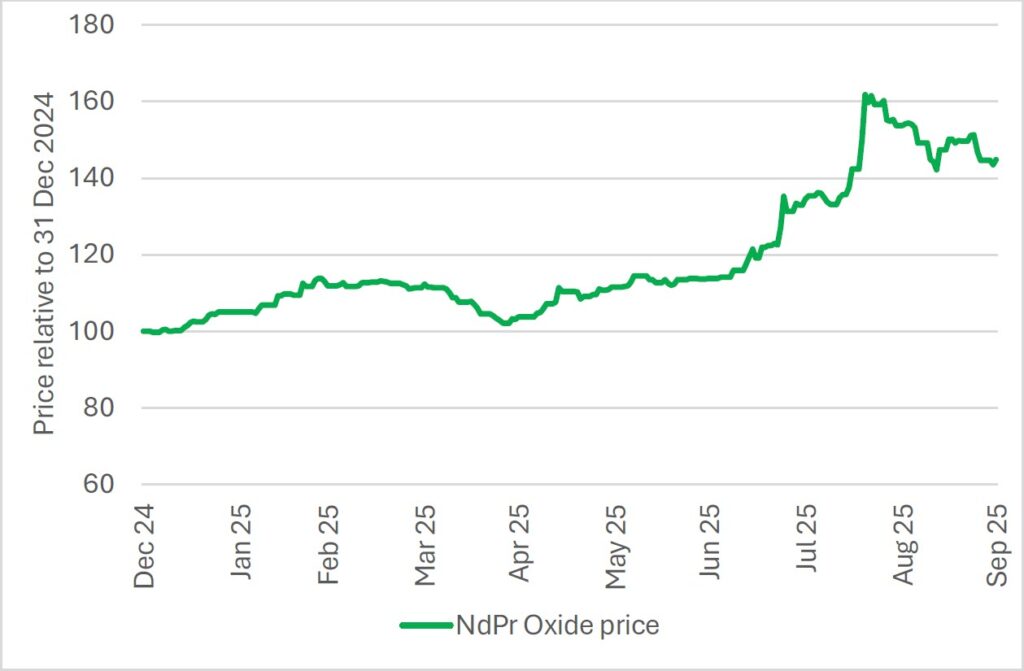

Not surprisingly, the Chinese spot market price for Neodymium-Praseodymium (NdPr) Oxide responded positively to the news, rising from $62/kg to $88/kg in less than six weeks, before topping out for the quarter. It was a sharp move upwards, accentuating a 44% price lift in NdPr oxide over the first nine months of 2025.

NdPr Oxide Price Change (2025 YTD)

Source: Bloomberg data, RCF Analysis, as of 30 Sep 2025

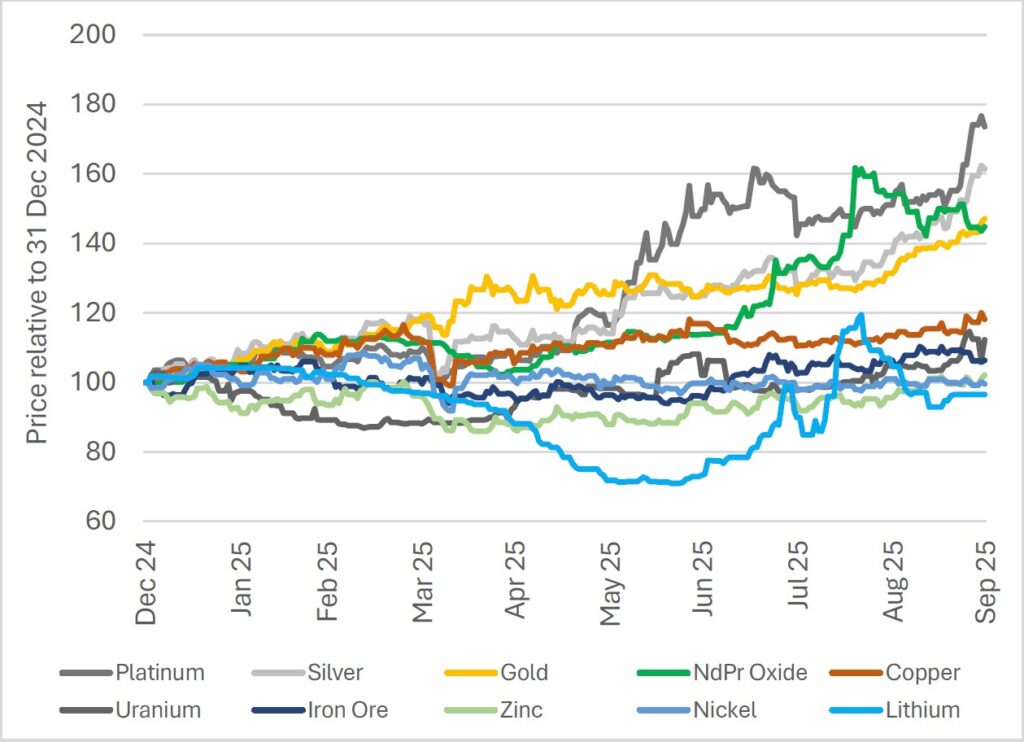

Despite the strong 3Q 2025 increase in NdPr oxide pricing, it is only the fourth best metals market on the year. Platinum, Silver and Gold have all outperformed the catalyst-driven move in rare earths, driven by improving supply & demand fundamentals. These relative price changes and others are shown in the following graph.

Selected Metal Price Changes (2025 YTD)

Source: Bloomberg data, RCF Analysis, as of 30 Sep 2025

This chart shows a clear stratification between precious metals + rare earths price on top, with industrial and battery metals lagging underneath, lower by more than 20%. This stratification is important background context, prior to finishing with the aggregate graphs.

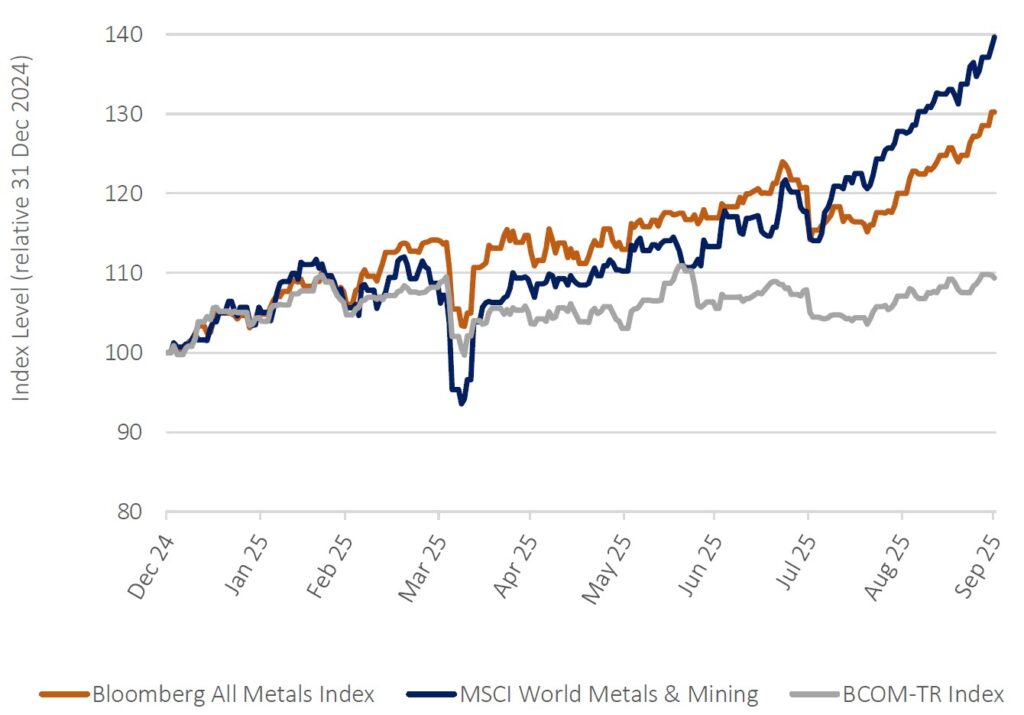

Commodity Price & Metals & Mining Equity aggregate indices (YTD 2025)

Source: Bloomberg data, RCF Analysis, as of 30 Sep 2025

The metals & mining sector stepped on the gas in the third quarter, with equity pricing aggregates overtaking underlying commodity prices, powered by margin expansion across the sector.

Specifically:

- The Bloomberg All Metals (orange line) broke clear of its aggregate BCOM-TR (grey line) at the end of Feb 2025.

- The MSCI Metals & Mining (blue line) equity index drew level with BCOM-TR in late June 2025, before accelerating rapidly to exceed underlying metals pricing (orange line) by the end of 3Q 2025.

Whenever the Bloomberg All Metals index (the metals price subset of BCOM-TR) grows more strongly than its aggregate BCOM-TR (30% Energy, 35% Agriculture and 35% Metals), revenue exceeds cost at the mining industry aggregate level. In 3Q 2025, it’s fair to say investors noticed the strong commodity prices and expanding margins, and the MSCI World Metals & Mining equity index took off.

To conclude, while everyone was focused on MP Materials and rare earths in 3Q 2025, there is a broadening and deepening of the factors that are positively contributing to the sector as a whole. RCF would summarize these factors by noting:

- Energy, Security & Technology demand drivers continue to positively impact supply & demand fundamentals

- Metals & Mining equities are organically enjoying EBITDA margin expansion, particularly in precious metals, and this has started to impact valuations and generalist investor interest in the sector

- Geostrategic and multipolar competition for scarce mining assets is increasing, driving risk & opportunity across the sector

As such, the overall investment environment remains positive for both new investments and precious metals exits going into Q4 2025.

Important Information

This material is provided for educational purposes only and should not be construed as research. The information presented is not a complete analysis of the commodities landscape.

Forward-looking statements are presented for illustrative purposes only and are not guarantees of future performance. Actual performance will vary due to a variety of factors, including general economic conditions. Neither RCF nor any independent third party has independently audited or verified this information.

The opinions expressed may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Resource Capital Funds and/or its affiliates (together, “RCF”) to be reliable. No representation is made that this information is accurate or complete. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

None of the information constitutes a recommendation by RCF, or an offer to sell, or a solicitation of any offer to buy or sell any securities, product or service. The information is not intended to provide investment advice. RCF does not guarantee the suitability or potential value of any particular investment. The information contained herein may not be relied upon by you in evaluating the merits of any investment.

References to market, composite, or commodity specific indices, determined by a third party, are provided for informational purposes only. Index information was compiled from sources that RCF believes to be reliable. No representation or guarantee is made hereby with respect to the accuracy or completeness of such data. Reference to an index does not imply that a fund will achieve returns or other results similar to the index. These indices cannot be invested in directly by a fund or other investors. The market volatility, liquidity, concentrations, restrictions and other characteristics of private market investments are materially different from indices, and therefore the indices do not necessarily reflect a basis for comparison with private market investments. The performance of these indices is reported on the gross performance of the underlying assets and does not take into account any fees or expenses that may be associated with investing in those assets. Any attempt to mimic the indices will result in fees and expenses associated with investing and will reduce performance.

Past performance is not indicative of future results. Investing involves risk, including possible loss of principal.