Rare earths are having a moment

On May 29, 2025, Resource Capital Funds gathered internal and external experts from four continents to discuss everything allocators need to know about rare earth elements (REEs). They shared their unique perspectives on current geopolitical environment, supply/demand dynamics, and the basics of the “what, where, and how” of rare earths, providing insights into rare earth element market dynamics.

Topics covered

Panelists

Dr. Luisa Moreno

Defense Metals

Director

Mark Seddon

Argus Media

Principal

Analytics &

Consulting, Metals

Simon Ford

RCF

Senior Director

Processing &

Metallurgy

Rob Gray

RCF

Chief Commodity

Strategist

Rich Brereton

RCF

Partner

Head of Investor

Relations

Access replay and request slides

If you would like to hear the entire conversation register here. If you would like access to the slides shared during the live webinar, please email: enquiries@rcflp.com

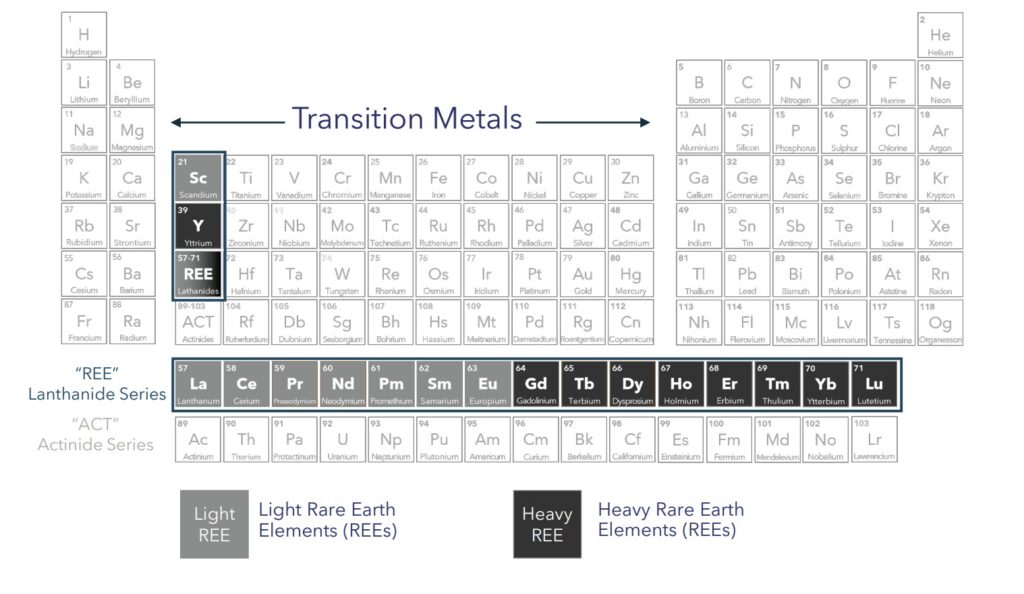

REEs: Not earths, not rare

Rob Gray

RCF

Chief Commodity

Strategist

“Rare earths are not actually earths; they’re metals with some unique properties. In addition, they’re not all that rare. Take neodymium, which is just critical for permanent magnet batteries. It’s about as prevalent as cobalt or nickel, but it’s produced at nowhere near the same rate.

There are 17 rare earths. One of the challenges is they are rarely found in highly concentrated deposits, which makes their extraction, and development quite challenging.

Lighter REEs – scandium, and the first seven elements of the Lanthanide series – are lighter in atomic weight. Yttrium, along with the right-hand side of the Lanthanide series, are the heavies. The heavies generally are much rarer in terms of their prevalence in the crust relative to the lighter rare earths.”

The four REEs that matter

Rob Gray

RCF

Chief Commodity

Strategist

“There are four rare earths of the seventeen that really matter in terms of societal benefit and in terms of future-facing technologies.

And those are the four rare earth magnet metals. There are two on the lighter end of the spectrum, and you have neodymium and praseodymium, or NdPr. And, on the heavier side, you have dysprosium (Dy) and terbium (Tb). Those are four elements that garner a lot of attention.

As we project where we’re headed in terms of demand and supply profiles, these are the four that are critical for permanent magnet electric motors going forward. Electric vehicles, robotics, advanced air mobility drones all need rare earth elements.”

Light Rees for Magnets

Heavy Rees for Magnets

Magnets

Refers to Neodymium Iron Boron (NdFeB) permanent magnets, which offer the highest magnetic strength at the least cost.

EVs drive REE demand

Mark Seddon

Argus Media

Principal

Analytics &

Consulting, Metals

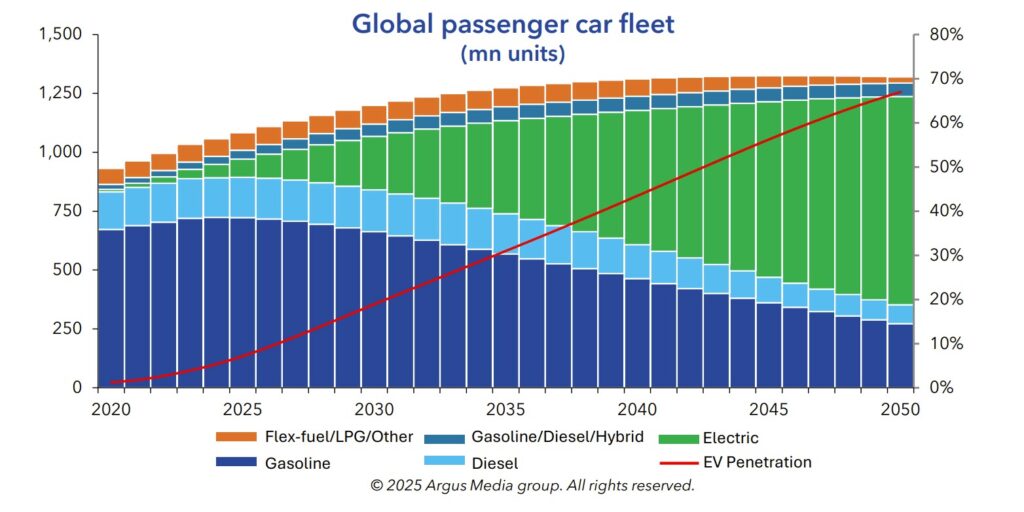

“As of now, what’s really driving the rare earth permanent magnet market is the automotive industry. People may realize that traditional internal combustion engine vehicles have lots of rare earth, permanent magnets in them. Anything that has an electric motor, whether it be electric windows, windscreen wipers, stereo system, all sorts of applications…these are all

rare earth, permanent magnets.

Where we get the growth in demand, is in the electric vehicles. A plug-in hybrid electric vehicle probably has 2-3 times as much rare earth permanent magnets by volume compared to a conventional vehicle, and a full battery electric vehicle has about 3-4 times as much by volume.

In 2020, only 1% of the vehicle fleet was an electric vehicle. By the time we get to 2030, we’re almost up to 20%. By 2040, we’re over 40%, and by 2050, we’re getting close to 70% of the vehicle fleet is an electric vehicle.”

EV penetration:

- 1% in 2020

- 19% in 2030

- 43% in 2040

- 67% in 2050

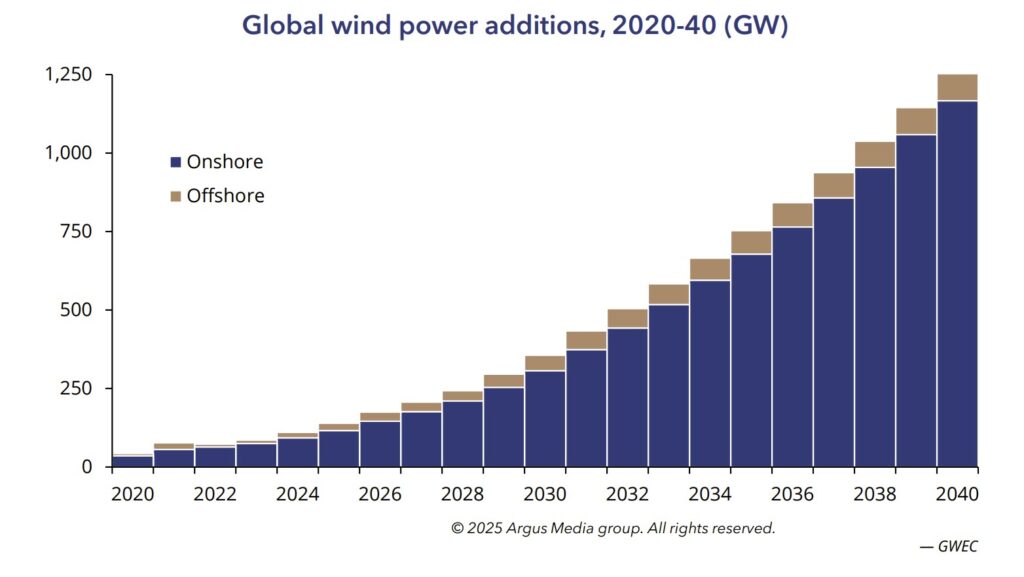

Offshore turbines rely on REEs

Mark Seddon

Argus Media

Principal

Analytics &

Consulting, Metals

“If we look at the wind turbine sector, rare earth permanent magnets are mainly used in offshore wind turbines because they are more reliable and they’re also more powerful.

So, offshore wind turbines tend to be direct driver, whereas onshore wind turbines can use a geared motor, and with a geared motor, you don’t necessarily need a rare earth magnet. There are some rare Earth magnets in onshore wind turbines, but the size of the motor in a wind turbine is orders

of magnitude bigger than even a battery electric vehicle.

Where you might be talking kilos in a car, you’re talking upwards of a ton in a wind turbine.”

REE economic deposits are rare

Dr. Luisa Moreno

Defense Metals

Director

“Rare earths are not rare. There are many projects around the world – north of 400 occurrences. Projects and mines of rare earths exist, but what is rare is to find economic deposits of rare earths. And, at current prices, there are not a

lot of projects that are truly economic.

These materials are highly strategic. They have significant optical, electronic, even mechanical uses. Small amounts of some REEs change base metals like aluminum, giving them significant strength. In the past 10 years, there has been widespread adoption of REEs, in robotics, information technology and even medicine. We will see significant demand for rare earth and other strategic materials even without electric vehicles. That is my belief.

But again, the question is, are they economic? The key is finding economic quantities and then processing them in an economic fashion. If the West want to be independent of China, it will be important to look globally and collaborate.”

REE processing is highly complex

Simon Ford

RCF

Senior Director

Processing &

Metallurgy

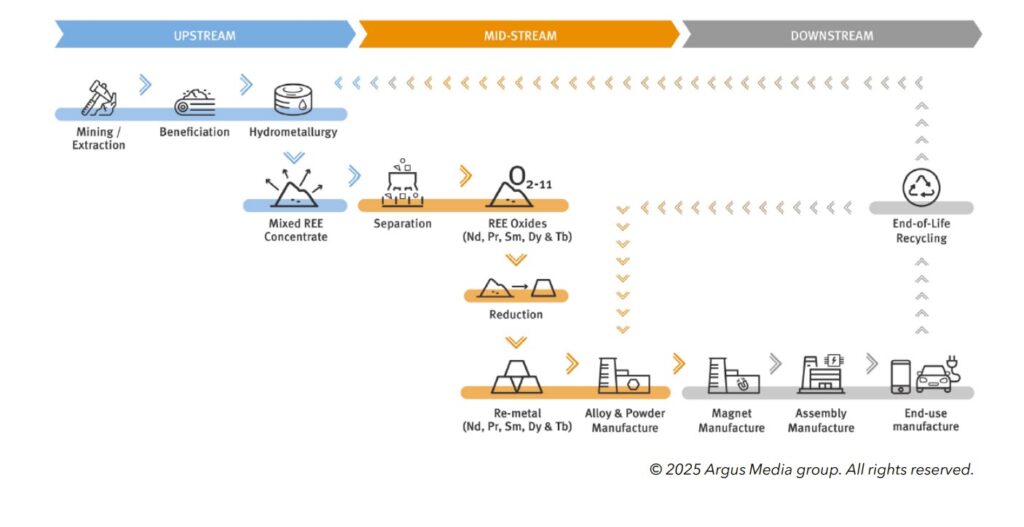

“It’s a simple chart, but processing a rare earth is by no means simple. This chart is broken down into upstream, midstream and downstream. Upstream is doing the mining and beneficiation. Midstream is, for example, separation

refining, and downstream is manufacturing.

No two rare earth deposits are the same. You can’t just take a flow sheet and say, ‘Well, I’m going to apply that and produce rare earths, because it’s not going to work.’ Each flow sheet has to be developed for a particular deposit.

It takes a lot of tests, rigorous test work. It’s a long chain. It’s complex. And difficult to achieve.”

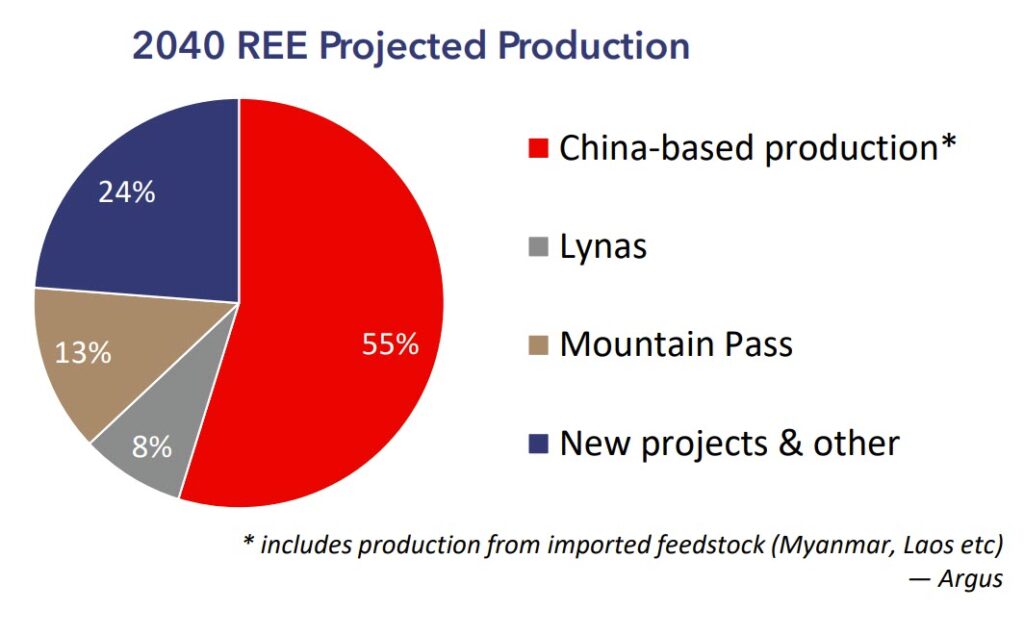

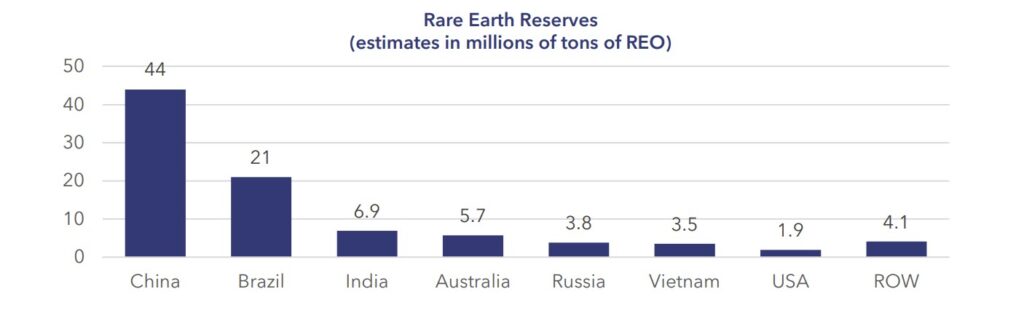

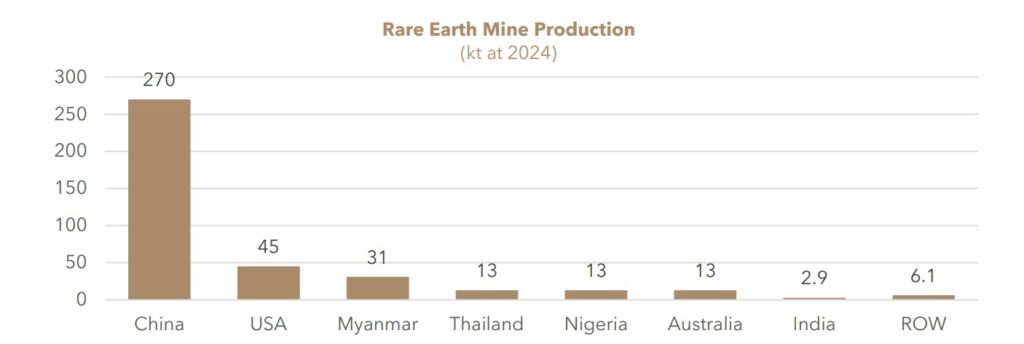

While China dominates, Brazil has potential

Simon Ford

“China dominates rare earth reserves and production. China has significant reserves as well. Brazil is second on the reserves list, but there’s only one current operator that recently started up. I expect to see more happening in Brazil, given the large reserves that sit in that country.”

Dr. Luisa Moreno

“Brazil does not produce a large amount. When Brazil is able to produce more rare earths, they will likely export to the rest of the world. Brazil is a major mining country and has always been an exporter of minerals. When they produce more, I think it would be accessible to North America and Europe.”

Geopolitical & legislative update

Mark Seddon

Argus Media

Principal

Analytics &

Consulting, Metals

“The key takeaway of the current geopolitical situation is that it’s obviously a little bit up and down, and nobody quite knows exactly what’s going to happen next week.

It’s helpful to look at jurisdictions.

Within the EU, the focus is on the EU Critical Raw Materials Act, which calls for less reliance on non-EU countries for critical materials. This includes rare earths,

and quite a lot of others. Effectively, they’ve got four key targets:10% of extraction; 40% of processing; 25% of recycling; and not more than 65% of annual consumption in the EU to be from any single nation.

The U.S. is moving away from the Inflation Reduction Act. The new administration issued an Executive Order called Restoring America’s Mineral Dominance, and that’s

keying in on domestic supply of critical materials. Obviously, we had the tariffs, and it’s a fluid situation.

China is focusing as much as it can downstream. It wants to protect its resources and move as far downstream as possible. Since April, they’ve imposed export controls on

samarium, gadolinium, terbium, dysprosium, lutetium, scandium, and yttrium, and they imposed a tariff on imports from Mountain Pass on the 17th of April. These

were countermeasures to the tariffs imposed by the U.S.”

Argus Media Group

Notices The Argus Media group (referred to herein as “Argus”) makes no representations or warranties or other assurance, express or implied, about the accuracy or suitability of any information in this presentation and related materials (such as handouts, other presentation documents and recordings and any other materials or information distributed at or in connection with this presentation).

The information or opinions contained in this presentation are provided on an “as is” basis without any warranty, condition or other representation as to its accuracy, completeness, or suitability for any particular purpose and shall not confer rights or remedies upon the recipients of this presentation or any other person. Data and information contained in the presentation come from a variety of sources, some of which are third parties outside Argus’ control and some of which may not have been verified.

All analysis and opinions, data, projections and forecasts provided may be based on assumptions that are not correct or which change, being dependent upon fundamentals and other factors and events subject to change and uncertainty; future results or values could be materially different from any forecast or estimates described in the presentation.

To the maximum extent permitted by law, Argus expressly disclaims any and all liability for any direct, indirect or consequential loss or damage, claims, costs and expenses, whether arising in negligence or otherwise, in connection with access to, use or application of these materials or suffered by any person as a result of relying on any information included in, or omission from, this presentation and related materials or otherwise in connection therewith.

The information contained in this presentation and related materials is provided for general information purposes only and should not be construed as legal, tax, accounting or investment advice or the rendering of legal, consulting, or other professional services of any kind. Users of these materials should not in any manner rely upon or construe the information or resource materials in these materials as legal, or other professional advice and should not act or fail to act based upon the information in these materials.

Copyright notice: Copyright © 2025 Argus Media group. All rights reserved. All intellectual property rights in this presentation and the information herein are the exclusive property of Argus and and/or its licensors and may only be used under license from Argus. Without limiting the foregoing, you will not copy or reproduce any part of its contents (including, but not limited to, single prices or any other individual items of data) in any form or for any purpose whatsoever without the prior written consent of Argus.

Trademark notice: ARGUS, the ARGUS logo, Argus publication titles, the tagline “illuminating the markets®”, and Argus index names are trademarks of Argus Media Limited. For additional information, including details of our other trademarks, visit argusmedia.com/trademarks.

Resource Capital Funds Disclaimers

This presentation is not an offer, solicitation, or invitation with respect to the purchase or sale of any security and/or any interest in a fund. This material is provided for educational purposes only and should not be construed as research. The information presented is not a complete analysis of the commodities landscape. The opinions expressed may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Resource Capital Funds and/or its affiliates (together, “RCF”) to be reliable. No representation is made that this information is accurate or complete. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information is not intended to provide investment advice. RCF does not guarantee the suitability or potential value of any particular investment. The information contained herein may not be relied upon by you in evaluating the merits of investing in any investment.

This presentation includes forward‐looking statements. Such forward‐looking statements are presented herein for illustrative purposes only to provide you with economic insights and anticipated risk and reward characteristics of certain investments. Such forward‐looking statements are inherently unreliable as they are based on estimates and assumptions about events and conditions that have not yet occurred and any of which may prove to be incorrect. In addition, the accuracy of such statements is subject to uncertainties and changes (including changes in economic, operational, political or other circumstances or the management of a particular portfolio company), all of which are beyond RCF’s control. There can be no assurance that any such expectations and projections will be attained. RCF undertakes no obligation to update or revise any forward‐looking statements, whether as a result of new information, future events or otherwise.

Investing involves risk, including possible loss of principal. Past performance is not indicative of future results.

Please note some of the quotes from the webinar have been edited for clarity.