California has consistently been at the forefront of regulating air quality standards – and the rest of the world has consistently followed. The state’s recent zero emissions vehicle (ZEV) mandate effectively bans internal-combustion engines (ICE) for transportation, making it the most far-reaching air-quality regulation yet. The new rules for reducing greenhouse gas emissions are absolutely achievable, but it will require massive amounts of capital and collaboration between investors and industry. And as a number of experts at September’s Battery Show in Detroit pointed out, much of that capital – and opportunity – will be in mining assets. But investment will have to come soon.

Figure 1: Copper Production Timeline

Source: S&P Global data, March 2021

As Figure 1 shows, it takes over 18 years to move from a copper discovery to a producing mine, so the industry is already five years behind.

The path to zero emissions

In 1966 California established the first tailpipe emissions standards in the US, followed by the creation of the powerful California Air Resources Board (CARB) in 1967. Because CARB and its mandates predated the federal Clean Air Act of 1970, Washington has authorized the state to set its own separate and stricter-than-federal vehicle emissions regulations.1

In September of 2020, Governor Gavin Newsom ordered CARB to develop “Passenger vehicle and truck regulations requiring increasing volumes of new zero-emission vehicles (ZEV) sold in the State towards the target of 100 percent of in-state sales by 2035.”2 Two years later, on Aug 25 of this year, the board voted on and unanimously approved a new rule putting that mandate into effect. It is the first regulation in the world to end the sale of internal-combustion engine (ICE) vehicles – other states and countries have set only voluntary targets.

Electric cars currently account for 12.6% of the US passenger vehicle market,3 or 800,000 of 13,000,000 passenger cars sold annually. Even if EV sales remained flat in the rest of the country, the new CARB mandate would double EV share to about 25% of the market, because California alone comprises about 12% of the US vehicle market. Of course, EV demand won’t stagnate, because the impact of CARB’s mandate will impact car buyers far beyond California’s borders.

15 states are set to follow California’s lead

There are currently 15 states that tie their clean air laws to California5, with a combined population of 131.5 million people, and low-emissions rules have tended to be quite popular. Unless these states take steps to decouple their emissions laws from California,6 then about 40% of the US population and vehicle market will ban the sale of ICE vehicles by 2035 in favor of electric vehicles (EVs) and other forms of zero-emission transportation (such as hydrogen fuel cell electric vehicles). Add to that the growing popularity of EVs, along with the likelihood of further mandates in other states and countries and you can start to understand why experts predict that EV sales will comprise 54% of the global vehicle market by 2035. And the prospect of EV sales overtaking ICE new vehicle sales is no longer a possibility or even a probability. It is a certainty.

Transforming a broad swath of the economy

The August 2022 CARB mandate is not just newsworthy, it represents a paradigmatic shift from previous regulatory structures. Generally speaking, air quality regulations to date have called for decreasing levels of combustion byproducts from the same source of propulsion – a gasoline (or diesel) engine. Until now, each new standard could be met by a refinement to existing ICE technology, such as adding a catalytic converter or programmable fuel injection. That is no longer the case. A ban on all combustion byproducts – and thus, internal combustion engines – effectively forces the entire automotive manufacturing and support sector to adopt new forms of propulsion technology with vastly different manufacturing processes and material requirements.

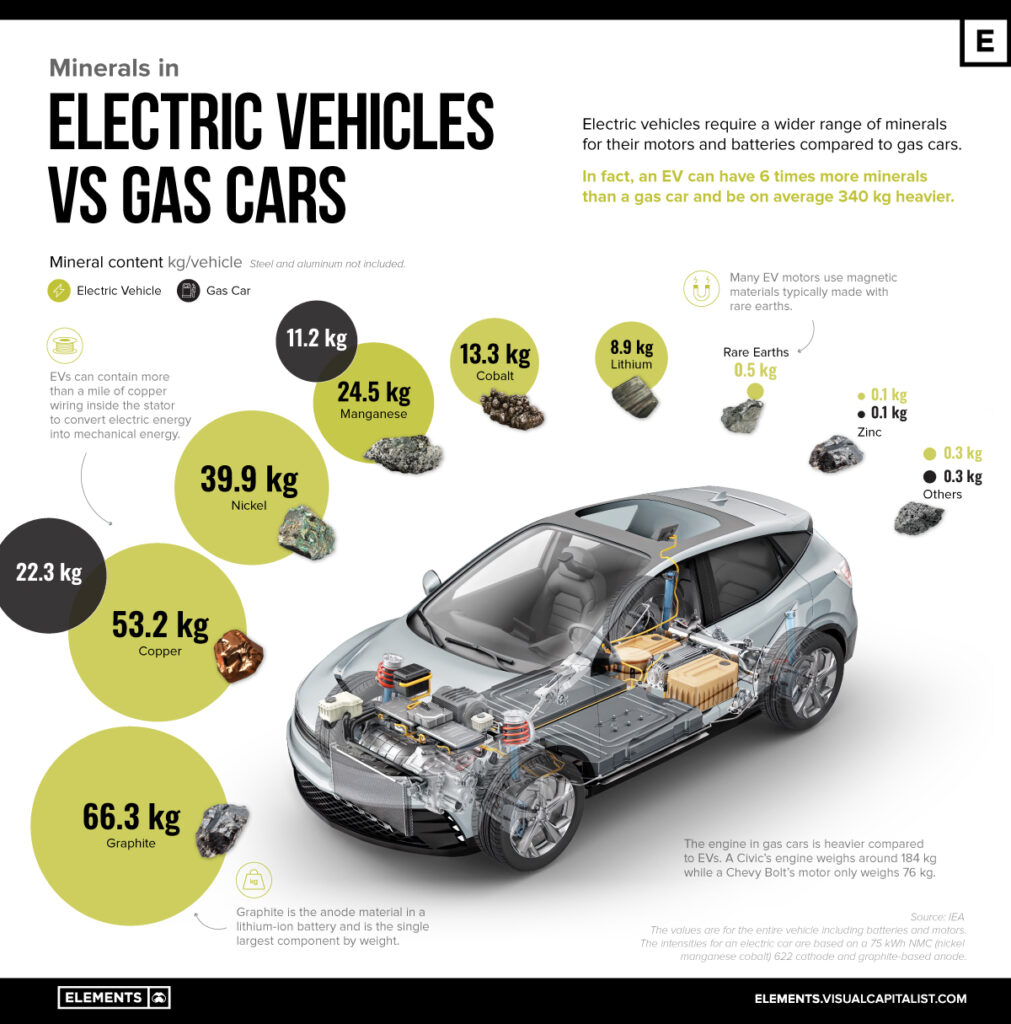

Figure 2: Minerals in Electric Vehicles vs. Gas Cars

EVs aren’t just gasoline powered cars with batteries in place of fuel tanks. Zero emission cars or light trucks are a fundamentally different type of manufactured product based on unrelated technologies, with significantly higher material requirements compared to an ICE vehicle. Research from the International Energy Agency has found that, not counting steel and aluminum (which is largely part of the body structure in gas powered cars), EVs can have 6X more minerals7 by weight than an ICE vehicle. EVs need significantly more copper, along with a wide assortment of minerals in relatively short supply, including graphite, nickel, manganese, cobalt, lithium, zinc, and rare earth elements8.

Li-ion battery technology value chains are currently being planned and constructed around the world to satisfy the demand for the millions of new electric vehicles and batteries being mandated. But a fundamental question remains: where will the raw materials come from to create those products?

Capital investment must enable the transition to EVs

Copper, nickel, lithium, cobalt, and other commodities essential to EV production are obtainable, but they must be extracted out of the ground, from new or expanded mining operations around the world. While increased recycling will contribute to supplies, there simply isn’t enough recyclable material to satisfy demand. An IEA study focused on the global EV battery supply chain2 found that to satisfy EV production requirements for fuel cells by 2030, the world will need:

- 50 more lithium mines – a six-fold increase over current production levels

- 60 more nickel mines – about double the current production

- 17 more cobalt mines – an increase of 75% over current levels

For that to happen, the mining sector – which investors have been neglecting for a number of years – will require significant new levels of capital investment. And the required investment capital is not coming from the global capital markets, as shown below:

Figure 3: Total Common Equity and Debt Capital Raised in Mining, 2000 – 2022

Dr. Fatih Birol, Executive Director of the IEA notes that “the data shows a looming mismatch between the world’s strengthened climate ambitions and the availability of critical minerals that are essential to realizing those ambitions.” 9

As the broader capital markets digest the significance of EV mandates and the transition to green energy, new sources of capital will inevitably start to flow into the mining sector. Investors will want to bypass downstream battery and EV manufacturers and gain exposure to potentially greater returns by investing more directly in underfunded upstream mining assets. However, in order to realize outsized returns, investors will want to be selective and work with experts who can identify the opportunities.

Mining isn’t one sector. It’s a multitude of sectors.

Mining investment can deliver outsized returns if investors understand the deposit inside and out, which is why broad index-type capital allocation strategies are less likely to succeed than more focused approaches. Why? In part because each metals & mining market is very different. Some metals, such as copper and zinc, have been mined for centuries. These mature market commodities have a very different investment dynamic than an accelerating growth market like lithium or a broadening mid-size market commodity such as nickel. Consider the demand profile acceleration of all four of these critical metals over the next decade alone:

Figure 4: Demand Projections for Copper, Zinc, Nickel, and Lithium

Source: AME, BNEF, S&P Global data, RCF Analysis, October 2022

Successful mining investment for the EV transition will depend on three factors

Mining assets are generally undervalued now, but that situation will not last. As the demand for raw materials to build EVs becomes increasingly apparent to investors, more capital will flow into the sector, reducing the number of investment opportunities to be had. But as important as it is to get in early, selectivity is paramount. As such, a successful approach to selecting opportunities should include:

1. ESG Stewardship

ESG concerns have deterred many from investing in the sector, but that will likely change with the realization that mining investment is not only compatible with but crucial to achieving broader sustainability goals. The mining industry is acutely aware of the importance of sustainable ESG performance in attracting and retaining investment. However, scrutiny from stakeholders such as CARB and downstream EV and battery manufacturers who are highly sensitive to environmental and sustainability concerns creates added complexity. This can be addressed with the right leadership, expertise, tools, and procedures in place needed to develop a profitable and sustainable mining operation.

2. Investment Expertise

Mining supply chains extend to the farthest reaches of the planet, but no two mines are alike – each operation must be optimized to a very specific location. So local networks with global reach are essential, along with experience in assessing mining management teams and their capabilities, financials, and the ability to invest and seize opportunities across all phases of mining from exploration to closure and reclamation. Capital markets experience is key, with the ability to see trends and disruption across both macroeconomic and commodity trends, providing insight into appropriate investment timing and hold periods.

3. Technical Mining Expertise

Detailed knowledge of geology, metallurgy, mine construction, commissioning and operating processes, and increasingly, mining technology and data analytics, must be brought to bear to unlock the potential of a mining operation and mitigate risk at any given phase.

The EV transition will underpin significant new metal demand over the next 20 years at a minimum, requiring trillions of new capital investment. Prolonged underinvestment in the metals & mining sector creates a scalable market investment opportunity, provided investors see the combined positive cyclical and secular forces at play. The energy transition vision and timeline has been laid down; now is the time to get busy delivering the zero-emission reality. The mining industry is ready to seize the opportunity; the question for investors is, which ones will get in on the ground floor?

Source of Data

1 History, The California Air Resources Board. https://ww2.arb.ca.gov/about/history.

2 Executive Order N-79-20, Executive Department State of California. https://www.gov.ca.gov/wp-content/uploads/2020/09/9.23.20-EO-N-79-20-Climate.pdf.

3 EV Sales Hit New Record in Q2 2022. https://www.coxautoinc.com/market-insights/ev-sales-hit-new-record-in-q2-2022/.

4 Cox Automotive Forecast: August U.S. Auto Sales Languish at Slow Pace With Persistent Headwinds. https://www.coxautoinc.com/news/cox-automotive-forecast-august-2022-u-s-auto-sales-forecast/.

5 State adoption of California Standards, United States vehicle emission standards. https://en.wikipedia.org/wiki/United_States_vehicle_emission_standards#State_adoption_of_California_Standards.

6 Several states will follow California’s lead in banning gas-powered car sales by 2035. https://thehill.com/changing-america/sustainability/infrastructure/3620985-several-states-will-follow-californias-lead-in-banning-gas-powered-car-sales-by-2035/.

7 Minerals used in electric cards compared to conventional cars. https://www.iea.org/data-and-statistics/charts/minerals-used-in-electric-cars-compared-to-conventional-cars.

8 The Key Minerals in an EV Battery. https://elements.visualcapitalist.com/the-key-minerals-in-an-ev-battery/. Global light duty EV sales to rise to 26.8 mil by 2030: Platts Analytics. https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/energy-transition/021622-global-light-duty-ev-sales-to-rise-to-268-mil-by-2030-platts-analytics.

9 The Role of Critical Minerals in Clean Energy Transitions. https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions.

10 Tesla needs nickel to dominate the car industry. It just signed a $5 billion deal with the metal’s largest source. https://fortune.com/2022/08/11/tesla-elon-musk-nickel-indonesia-deal-jokowi-tsingshan/.

Important Information

This material is provided for educational purposes only and should not be construed as research. The information presented is not a complete analysis of the commodities landscape.

The opinions expressed may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Resource Capital Funds and/or its affiliates (together, “RCF”) to be reliable. No representation is made that this information is accurate or complete. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

None of the information constitutes a recommendation by RCF, or an offer to sell, or a solicitation of any offer to buy or sell any securities, product or service. The information is not intended to provide investment advice. RCF does not guarantee the suitability or potential value of any particular investment. The information contained herein may not be relied upon by you in evaluating the merits of any investment.

Investing involves risk, including possible loss of principal.